Why Amazon and friends' plan could be a major disrupter of health care system

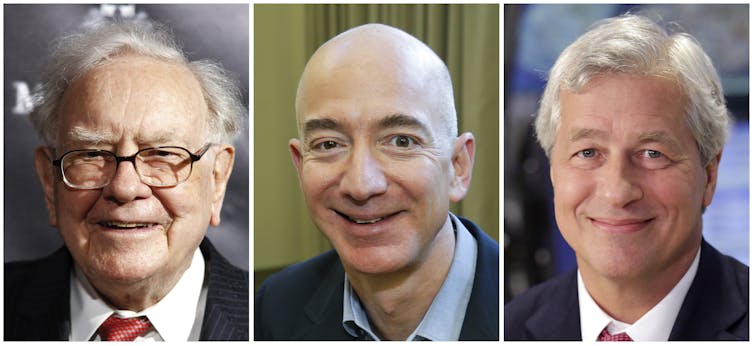

Three business giants, Amazon, Berkshire Hathaway and JPMorgan Chase, announced plans to change health care delivery and insurance as we know it. Here's why that could be a major disruption.

Amazon, Berkshire Hathaway and JPMorgan Chase’s announcement that they will create an independent company to offer health care to their employees “free from profit-making incentives and constraints” sent a shock through the health care industry, with share prices of some incumbents tumbling on Jan. 30.

Of course, this is not a surprise since anything Amazon, for one, takes on shakes the incumbents. But this one might be different.

As a former health insurance CEO and professor, I see that, based on their history and financial power, this new company could be a disruptive force in the industry.

A complex system

While most people experience insurance and doctors as the face of the health care sector, the moving parts of health care are much more complex. Only recently have doctors and insurers even been able to talk the same language through a massive federally financed move toward electronic medical records. And even then, insurers talk in terms of billing codes, while doctors deal with diagnoses and outcomes.

The marriage of the two through new organizational forms such as Accountable Care Organizations and payment units like bundled payments – for something like a hip or knee replacement, for example – show promise that the elements can collaborate but only in defined areas. Mainly these approaches are designed to bring the most excessive doctors and hospitals back toward the average in terms of cost. But even average health care costs are too high, and the outcomes are too poor to satisfy most Americans.

Into this maelstrom comes the party with the most to gain and the best leverage to change the system — and I mean employers, not the government.

Most insurance isn’t really insurance

You may not know that most employer-based “insurance” isn’t insurance at all. It’s just a way for a contracted entity that looks like an insurer to act as a purchasing agent and paymaster for the real deep pockets: the self-insured employer.

Any employer with at least 100 or 200 employees can do much better just writing the check for what is spent on health care rather than paying an insurance company to bear the risk. They only have to have “reinsurance” to cover the costs above the level that they can finance themselves.

It is interesting to note that one of the largest U.S. reinsurance companies, Gen Re, is at the core of Berkshire Hathaway’s empire.

Clearly, there’s a potentially powerful force for change in the self-insured employer who, in aggregate, covers over 100 million people and is exempted from much state regulation by federal law.

In the past, there have been five major ways these employers have attacked the health care “tapeworm” described by Warren Buffett. Through their insurance company agents, they can:

Hire a manager to do it (i.e., managed care), or pay them a flat amount each year (i.e., fixed amount per employee per year), or both.

Channel employees to the “best” providers (i.e., narrow networks and direct contracts with centers of excellence).

Change the incentives for the employee to be more careful (i.e., high deductible health plans) and help them save for routine needs through, for instance, health savings accounts.

Encourage them to shop more carefully with online comparison tools for quality plus differential co-pays for favored providers.

Maintain a lifestyle of “wellness” through, for example offering membership to health clubs, discounts for Fitbit health tracking devices, or a direct bonus or penalty.

But none of these have done the job.

So what do these three big disrupters expect?

Besides being large employers themselves, Warren Buffett knows insurance through his Gen Re reinsurance company. Amazon has taught everyone how to shop far better online than in stores, and JPMorgan has had extensive experience with Health Savings Accounts, which are tax-sheltered savings accounts paired with high-deductible insurance polices that eligible people can use to pay for health care costs. They know the elements of the past playbook individually.

But their announcement signals that the goal is something much more: an integrated technology-driven approach to all facets of health care beyond the earlier individual initiatives.

While they did not mention the changes that must happen in the delivery sector, implied is the assumption that doctors and hospitals will adapt to this new world, holding down their costs, making prices more transparent, and innovating in their physical and electronic delivery of care.

While these issues are all important, this partnership does not address other problems of the broken U.S. health care system and its ever-expanding costs. Also of concern are the role of skyrocketing drug prices protected by patents and direct-to-consumer advertising; expensive end-of-life decisions; explosive potential use of genetic information; and prevention and management of chronic conditions derived from personal choices.

And the most critical factor in the success of their plan is the fact that the doctor knows the medical facts better than the patient or purchaser. We want a medical expert to tell us what must be done in any situation. But, when the incentives for the physician agent are not aligned with broader objectives, their decisions may be less than optimal, and this is often the case.

One has to applaud the initiative if you are outside the health care sector and fear it if you are inside. When these three threaten to disrupt an industry, those in it had better listen carefully and adapt as quickly as they can.

J.B. Silvers is on the board of MetroHealth Systems in Cleveland, Ohio.

Read These Next

GLP-1 drugs may fight addiction across every major substance, according to a study of 600,000 people

GLP-1 drugs are the first medication to show promise for treating addiction to a wide range of substances.

Hezbollah − degraded, weakened but not yet disarmed − destabilizes Lebanon once again

Hezbollah’s entry into the current war followed the killing of Ayatollah Ali Khamenei. The group has…

Congress once fought to limit a president’s war powers − more than 50 years later, its successors ar

At the tail end of the Vietnam War, Congress engaged in a breathtaking act of legislative assertion,…