Why market competition has not brought down health care costs

GOP lawmakers say their bills to replace the Affordable Care Act would do a better job than the ACA of controlling rising health care costs, but 40 years of deregulation show it just won't work.

It is easier than ever to buy stuff. You can purchase almost anything on Amazon with a click, and it is only slightly harder to find a place to stay in a foreign city on Airbnb.

So why can’t we pay for health care the same way?

My research into the economics of health care suggests we should be able to do just that, but only if we say goodbye to our current system of private insurance – and the heavy administrative burden that goes along with it. Republican efforts to repeal the Affordable Care Act (ACA) would take us in the wrong direction.

What makes health care so complicated

In a way, the reason buying health care is different than shopping for a garden gnome or short-term apartment seems obvious. Picking the right doctor, for example, involves a lot more anxiety and uncertainty and concerns matters of life and death.

But that’s not really the reason we can’t purchase health care the same way we buy an iPhone. In 1969, this would almost be true (for a rotary phone anyway). Back then, the bill for a birth in a New Jersey hospital looked a lot like the receipt you’d get for buying pretty much anything else: customer name, amount and a box to be checked for payment by check, charge or money order.

Today, paying for even the simplest office visit can become a nightmare, requiring insurance preauthorization, reimbursements adjusted for in-network or out-of-network copays and deductibles and the physician “tier” (or how your prospective doctor is evaluated for cost and quality by the insurance company).

Prescriptions require even more authorizations, while follow-up care necessitates coordinated review – and it goes without saying that many forms will have to be completed. And this doesn’t end when you arrive at the doctor’s office. A large chunk of any visit is spent with a beleaguered nurse, or even the physician, filling out a required checklist of insurance-mandated questions.

The growing complexity of health care finance explains why it’s becoming more and more expensive even though there has been little or no improvement in quality. Since 1971, the share of our national income spent on health care has doubled.

We can blame a significant part of the soaring cost of health care on the ever-increasing burden of administrative complexity, whose cost has climbed at a pace of more than 10 percent a year since 1971 and now consumes over 4 percent of GDP, up from less than 1 percent back then.

Lemons and cherries

So if the rising cost of administration is a primary force driving health care inflation, why don’t we do something about it?

That’s because administrative complexity and waste are no accident but rather are baked into our private health insurance system and made worse by continuing attempts to use competitive market processes to achieve social ends other than maximizing profit.

Paying a doctor was relatively simple in the 1960s. Most people had the same insurance policy, issued by Blue Cross and Blue Shield, which back then was a private company but operated like a non-profit under strict regulation.

But in hopes of controlling steadily rising costs, policymakers encouraged insurers besides Blue Cross to enter health insurance markets, beginning with the HMO Act of 1973. The proliferation of for-profit companies with competing plans raised billing costs for health care providers, which now had to submit claims to a multitude of different insurers, each with its own codes, forms and regulations.

Not only that, but insurers quickly discovered the dirty secret of health care finance: Sick people are expensive and make up most costs, while healthy people are profitable.

In other words, the vital lesson for an insurer looking to make money is to identify the few sick people and get them to go away (“lemon dropping”) and find the healthy majority and do things that attract them to your plan (“cherry picking”).

Insurers are happy to offer discounts on fitness club memberships to attract healthy people, for example. But they punish the sick with higher copays and deductibles, as well as increasingly restrictive and intrusive regulations on preauthorization.

Economists call it adverse selection. Regular people call it paperwork hell. Whatever the name, it’s the purpose of increasingly complicated insurance plans and reimbursement forms.

A failure to fix

The public and government authorities figured this out quickly, but too often the cures have been as bad as the disease.

We could, and I believe should, have abandoned the use of for-profit private insurance to adopt a simple single-payer system, in which a government agency would provide coverage to everyone in the U.S. Instead, in forging the ACA and in every other health reform enacted in the past 40 years, policymakers decided to work with private insurance while trying to fix some of its evils.

We adopted the “Patient’s Bill of Rights” around the turn of the century and created processes to allow patients and providers to appeal medical decisions made by insurers. State health commissioners now have considerable power to supervise insurers, while the ACA mandates certain essential benefits be provided in all insurance plans.

Yet each of these efforts to protect the sick from abuses inherent in the for-profit insurance system only added to the administrative burden, and the costs, on the entire industry.

Some perceived the problem as a lack of market competition so governments freed hospitals and other health care providers from regulations on prices and restrictions on mergers, advertising and other practices. Far from reducing administrative complexity or lowering prices, research has shown that deregulation made both problems worse by allowing the formation of networks of hospitals and providers who use advertising and other business and financial practices to **control markets and stifle competition.

Simply put, each attempt to fix a problem has led to more administration because we have kept intact the system of private health insurance – and for-profit medicine – that is at the root of at the dual problems of rising health care costs and growing complexity.

It’s time to take a step back

Clearly, our experiment in market-driven health care has gone awry.

Before we introduced competition and deregulation into health care, things were relatively simple, with most revenue going to providers. We could save a lot of money if we went backwards and adopted a single-payer system like Canada’s, where insurers do not engage in systematic preauthorization or utilization review and hospitals and pharmaceutical companies do not form monopolies to profit at the expense of the public.

Largely by reducing administrative costs within the insurance industry and to providers, a single-payer program could save enough money to provide health care to all Americans.

Compared with Canada’s single payer system, American doctors and hospitals have nearly twice as many administrative staff workers.

So whether the ACA remains in force or it’s replaced by something else, I believe we won’t be able to control health costs – and make health care affordable for all Americans – until we revamp the system with something like single payer.

Gerald Friedman belongs to the Massachusetts Society of Professors (a National Education Association affiliate) and Democratic Socialists of America. He has done some consulting work for the Vermont State Employees and has written reports on single-payer plans for several states, including Maryland, Pennsylvania and New York.

Read These Next

Drug company ads are easy to blame for misleading patients and raising costs, but research shows the

Officials and policymakers say direct-to-consumer drug advertising encourages patients to seek treatments…

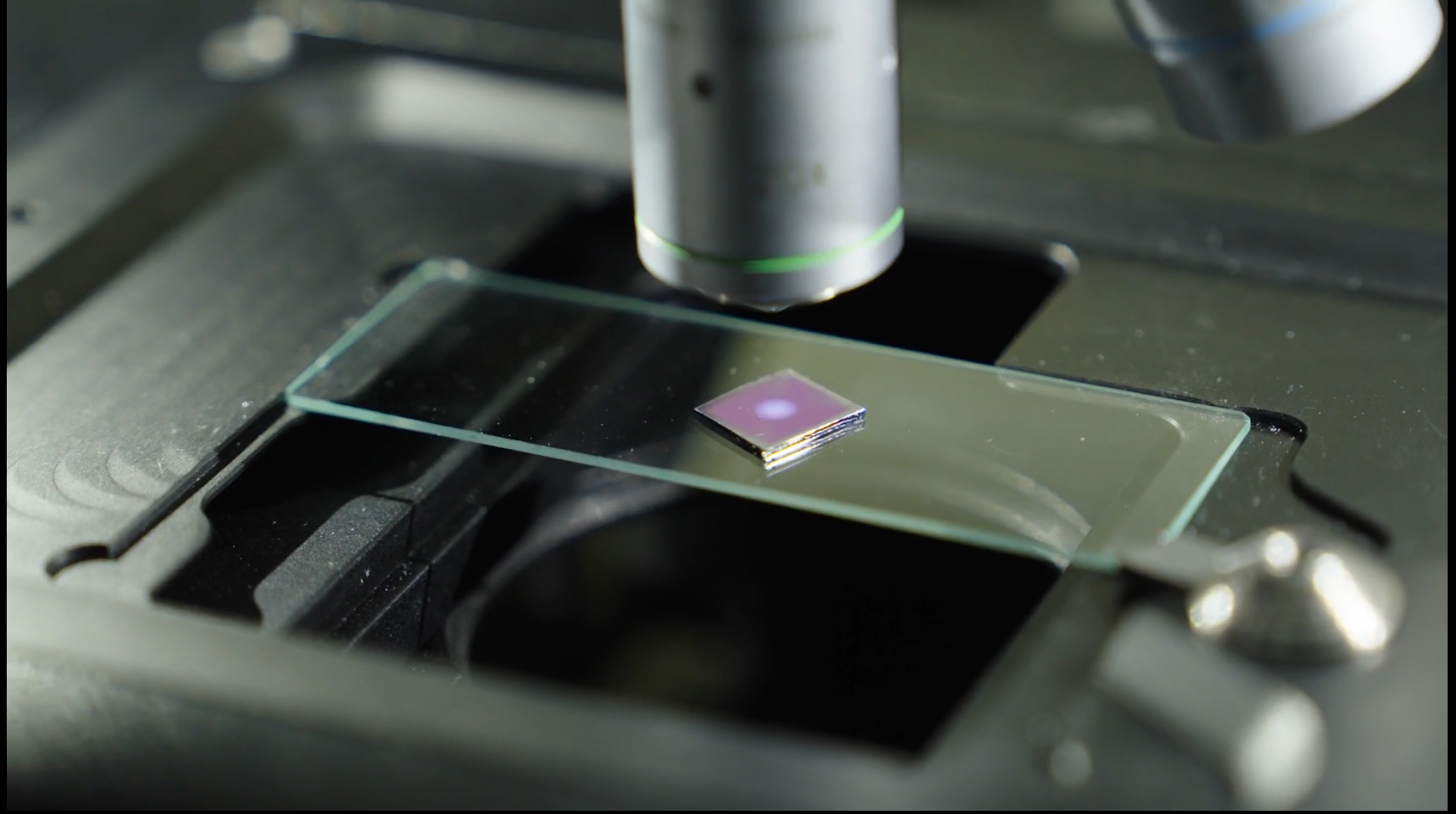

Nanoparticles and artificial intelligence can help researchers detect pollutants in water, soil and

Tiny particles bounce light around in a unique way, a property that researchers are using to detect…

Tiny recording backpacks reveal bats’ surprising hunting strategy

By listening in on their nightly hunts, scientists discovered that small, fringe-lipped bats are unexpectedly…