How much do you need to know about how your spouse spends money? Maybe less than you think

A researcher explains how couples can create a sense of ‘our money’ while keeping a sense of financial autonomy.

Love is in the air, and wedding season is upon us.

Like many elder millennials, I grew up watching sitcoms in the 1980s and ‘90s. Whenever those series needed a ratings boost, they would feature a wedding. Those special episodes taught me that weddings usually involve young lovebirds: think Elvin and Sondra from “The Cosby Show,” Cory and Topanga from “Boy Meets World,” or David and Darlene from “Roseanne.”

But those were different times. People are getting married later in life than they used to: In the United States, the median age of newlyweds has grown to 28 for women and 30 for men.

This trend means that many Americans now enter marriage after being self-reliant for several years, including managing their own money. Will they be eager to change that once they get married? Don’t count on it. A 2017 Bank of America survey suggests that millennial married couples are around 15 percentage points more likely than their predecessors to keep their finances separate.

This is not necessarily a good development. As a behavioral scientist who studies money and relationships, I find that joint accounts can bring partners closer.

There are some risks, however. Joint accounts create transparency, and intuitively, transparency feels like a good thing in relationships. But I argue that some privacy is important even for highly committed couples – and money is no exception.

The newlywed game

Behavioral scientists Jenny Olson, Deb Small, Eli Finkel and I recently conducted an experiment with engaged and newlywed couples. Each of the pairs had entirely separate accounts, but they were undecided about how they wanted to manage their money moving forward.

We randomly assigned each of the 230 couples to one of three groups. One group kept their money in separate accounts; one merged their cash into a joint account and stopped using separate accounts; and one managed their money however they liked.

We followed couples for two years, periodically asking them to complete surveys assessing their relationship dynamics and satisfaction. Our relationship quality measure included items such as “I cannot imagine another person making me as happy as my partner does” and “Within the last three months, I shouted or yelled at my partner.”

Among the couples who could do whatever they wanted, most kept things separate. They and the couples assigned to keep separate accounts experienced a steady decline in relationship quality over time.

This is a fairly typical pattern. For instance, in a large study that tracked U.S. couples’ marital happiness for 17 years, sociologist Jody Van Laningham and colleagues found that “marital happiness either declines continuously or flattens after a long period of decline.”

Declines during the first two years of marriage are particularly important. Social scientist Ted Huston and colleagues call those first two years the “connubial crucible.” They find that relationship dynamics that develop during that crucial period can foreshadow relationship quality for many years to come.

Couples in our study who were prompted to take the plunge into a joint account, however, maintained their initial level of relationship satisfaction over the course of the two-year experiment.

Tit-for-tat

Our survey results suggest that, by turning “my money” and “your money” into “our money,” a joint account can help to reduce scorekeeping within a relationship. For example, we found that couples with joint accounts were more likely to agree with statements such as “When one person does something for the other, the other should not owe the giver anything.”

Relationships usually don’t start with a scorekeeping orientation. In the 1980s and ‘90s, psychologist Margaret Clark and colleagues conducted experiments where partners had the option of keeping track of each other’s contributions to a shared task. They observed that intimate relationships often begin with a “communal” orientation, where partners help one another without keeping careful track of who’s doing what.

Eventually, however, they take on more of an “exchange” orientation – where inputs are tracked and timely reciprocity is expected. Couples that manage to stave off a tit-for-tat mindset tend to be happier.

Too much of a good thing?

The data from our experiment with young couples clearly suggests that using only a joint account is better than using only separate accounts. However, I argue in my new book, “Tightwads and Spendthrifts,” that just a joint account is probably not optimal.

When partners use only a joint account, they get an up-close-and-personal view of how the other person is spending money. This kind of transparency is normally viewed as a good thing.

Some commentators argue that a healthy marriage should have no secrets whatsoever. For example, Willard Harley, Jr., a clinical psychologist who primarily writes for Christian audiences, argues that you should “reveal to your spouse as much information about yourself as you know: your thoughts, feelings, habits, likes, dislikes, personal history, daily activities, and plans for the future.”

In addition, if your goal is to minimize optional spending, research suggests that the transparency that comes with a joint account can be helpful. We spend less when someone is looking over our shoulder.

Still, there are reasons to believe that complete transparency can be harmful for couples.

Many people have become convinced that if they could just stop buying lattes and avocado toast, they could invest that money and become rich. Unfortunately, the underlying math is highly dubious, as journalist Helaine Olen points out in her book “Pound Foolish.” Still, many people view small indulgences as their primary obstacle to wealth. Complete transparency around these financially inconsequential “treats” can lead to unnecessary arguments.

Also, spouses may have different passions that their partner does not fully understand. Expenses that seem perfectly reasonable to another hobbyist may seem outrageous to someone without the proper context – another source of avoidable disagreements.

'Translucent,’ not transparent

I propose that many couples may benefit from a combination of joint and separate accounts.

A joint account is essential for ensuring that both partners have immediate and equal access to “our money.” Ideally, all income would be direct-deposited into the joint account, which would help to blur the gap between partners’ earnings. Conspicuous income differences can jeopardize relationship quality.

Separate accounts attached to the joint account can allow some privacy for individual purchases and help partners maintain a sense of autonomy and individuality. Each person gets to spend some of “our money” without their partner looking over their shoulder. Spouses would have a high-level understanding of how much their partner is spending per week or per month, but avoid the occasionally irritating details.

This kind of partial financial transparency – what I call “financial translucency” – could help couples strike the right balance between financial and psychological well-being.

Of course, this approach requires a lot of trust. If the relationship is already on thin ice, complete financial transparency may be necessary. However, if the relationship is generally in the “good, but could be even better” category, I would argue that financial translucency is worth considering.

Scott Rick received a grant from the Russell Sage Foundation for the joint/separate account experiment described here.

Read These Next

Rescheduling marijuana would be a big tax break for legal cannabis businesses – and a quiet form of

Consequences will go far beyond the tax bill that businesses face, a tax law professor explains.

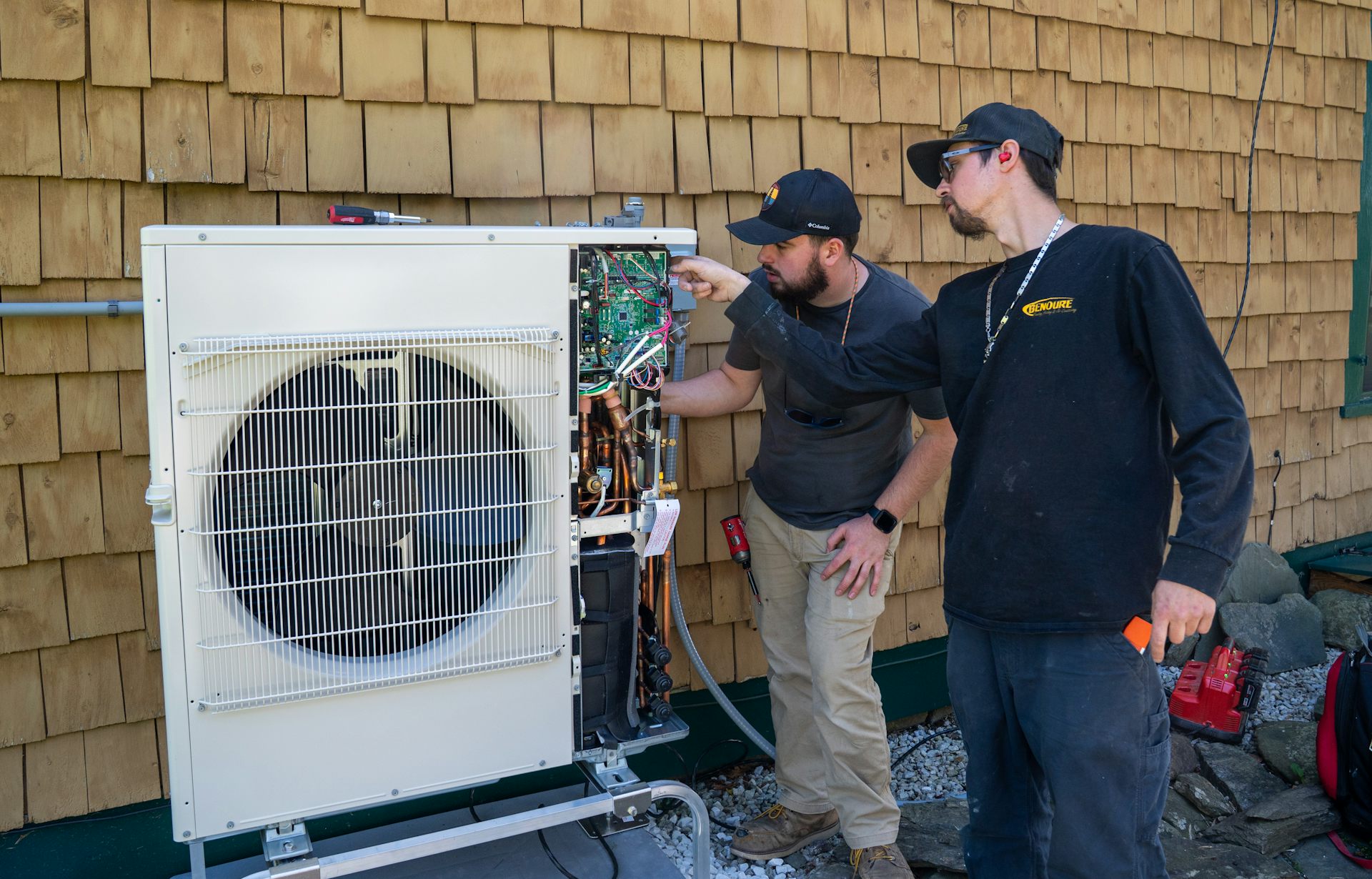

Americans want heat pumps – but high electricity prices may get in the way

Many homeowners could save money on their heating bills by installing heat pumps – but not everyone,…

EPA’s new way of evaluating pollution rules hands deregulators a sledgehammer and license to ignore

In the world of cost benefit analysis, if an impact isn’t monetized, it doesn’t exist. A former…