How rich are the rich? If only you knew

Income inequality, the most common way to measure the gap between the rich and the poor, only tells part of the story. Wealth inequality tells the rest.

“If poor people knew how rich rich people are, there would be riots in the streets.”

Actor and comedian Chris Rock made this astute statement during a 2014 interview with New York magazine, referring to the yawning gap between rich and poor. In so doing, he stumbled upon a key challenge in the study of inequality.

What’s the best way to measure it?

Most inequality studies have focused on income – measures of which are widely available. However, being rich is not about a single year of earnings but rather about the accumulation of wealth over time. In the past, quantifying that has been tricky.

The wealthy would probably prefer we stay in the dark about how rich they are, presumably to avoid the aforementioned riots. People like me who study the topic, however, are always looking for more data and better and more accurate ways to measure the rich-poor gap. And while I’m not one to promote violence in the streets, I do believe it’s important for citizens to be fully aware of the levels of disparity in their society.

The most revealing way to do this, in my view, is by looking at wealth inequality.

Measuring the rich-poor gap

There are several ways to measure inequality.

One of the most popular is by income. That’s largely because there’s more data, and it’s a lot easier to measure. But this measure is a snapshot.

Wealth, on the other hand, is an aggregation, affected not only by current income but earnings accumulated in previous years and by previous generations. Only by studying wealth inequality do scholars, policymakers and others get the deepest and broadest measure of the gap between the rich and everyone else.

How much wealth someone has is also a better measure of their quality of life and opportunities. It determines the ability to invest in education, financial assets and the comfort and security of one’s retirement. Wealth also mitigates worries about paycheck variability or unexpected expenses. If you have wealth, the sudden cost of replacing a broken water heater or paying a medical bill doesn’t cause nearly as much stress as if you’re poor.

American ‘exceptionalism’

When we do look at the data on wealth inequality in the U.S., it’s stark and dwarfs that of the rest of the developed world.

The conservative Hudson Institute in 2017 reported that the wealthiest 5 percent of American households held 62.5 percent of all assets in the U.S. in 2013, up from 54.1 percent 30 years earlier. As a consequence, the wealth of the other 95 percent declined from 45.9 percent to 37.5 percent.

As a result, the median wealth of upper-income families (earning US$639,400 on average) was nearly seven times that of middle-income households ($96,500) in 2013, the widest gap in at least 30 years.

More notably, inequality scholars Emmanuel Saez and Gabriel Zucman found that the top 0.01 percent controlled 22 percent of all wealth in 2012, up from just 7 percent in 1979.

If you only looked at data on income inequality, however, you’d see a different picture. In 2013, for example, the top 5 percent of households earned just 30 percent of all U.S. income (compared with possessing nearly 63 percent of all wealth).

While the U.S. is not the only developed country that has seen wealth inequality rise over the past three decades, it is an outlier. The wealthiest 5 percent of households in the U.S. have almost 91 times more wealth than the median American household, the widest gap among 18 of the world’s most developed countries. The next highest is the Netherlands, which has a ratio less than half that.

Lifting all boats?

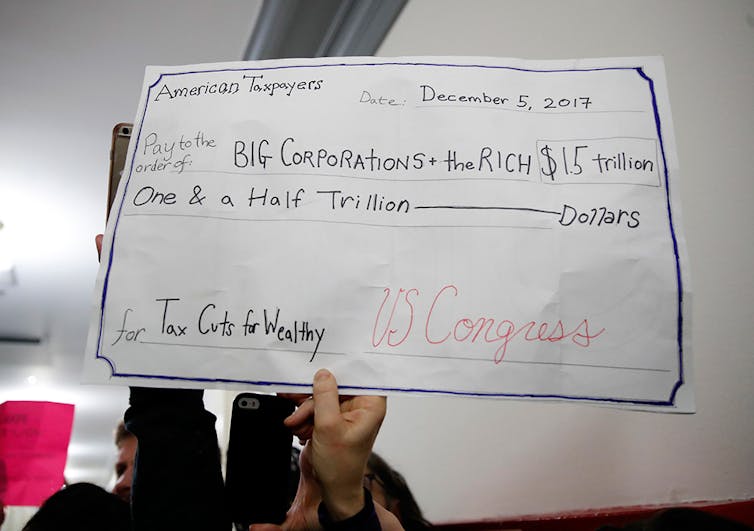

The recently passed Tax Cuts and Jobs Act will make this problem a whole lot worse.

The main features of the law include doubling the standard deduction for individual taxpayers, a temporary reduction in the top marginal tax rate from 39.6 percent to 37 percent, a significant reduction of the number of families subject to the estate tax and slashing the top corporate rate from 35 percent to 21 percent.

The main impact, however, is skewed to the wealthy. For example, the bottom 20 percent of households will see a lower tax bill of about $40 on average, compared with $5,420 for those in the top quintile. The richest 0.1 percent, meanwhile, will save $61,920. By 2025, the richest will see their benefit grow to $152,200, while everyone else won’t see much of a change. All the individual cuts are set to expire in 2026.

Wealthier taxpayers will also gain from the other main features of the new law. For example, research shows most benefits of lowering business taxes go to the rich, and fewer estates subject to the inheritance tax means more wealth accumulation across generations.

The tax law’s proponents claim that it won’t increase levels of inequality because the money that the rich will save will “trickle down” to other American households and lift their boats too.

Empirical evidence, however, suggests otherwise. Specifically, channeling more money to the rich, via tax cuts, does not improve economic growth, worsens educational opportunities for poorer Americans and even reduces life expectancy, which declined for a second year in a row in 2017.

Let’s learn the facts

So is Chris Rock right that Americans just aren’t aware of the levels of disparity in their society?

Surveys suggest he is. Respondents to a 2011 national survey, for example, “dramatically underestimated” levels of wealth inequality in the U.S.

The survey, and other research, also partially affirmed the other half of his quote by showing that by and large Americans do care about wealth inequality and would prefer it to be lower.

Whether existing wealth inequality in the U.S. is socially or morally sustainable – or might lead to the riots envisioned by Chris Rock – is an open question.

Whatever happens, first things first, we need to know and understand just how bad wealth inequality in the U.S. has become. What we then choose to do about it is up to all of us.

Gil B. Manzon Jr. does not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

Read These Next

When unpaid cooking, cleaning and child care get a dollar value, income inequality in the US shrinks

Women’s unpaid work at home has declined much more than men’s contributions have increased.

Far from random, China’s global port network is clustering near the world’s riskiest trade routes

A review of 133 countries’ ports found a correlation between investment from China and proximity to…

CIA agents successfully executed a plan for regime change in Iran in 1953 – but Trump hasn’t reveale

A covert US campaign in the mid-20th century helped steer Iran toward the intense anti-American sentiment…