Taxpayers want more fairness. GOP plan to 'reform' the tax code doesn't deliver

Far from dispelling the notion among Americans that the system is 'rigged' against them, Republican tax plans are more likely to make matters worse.

Republicans seem to be operating under the assumption that if the details of their tax “reform” plan are aired for too long, the whole thing might fall apart.

The House passed its version of the most sweeping overhaul of the tax code in a generation on Nov. 16, barely seven weeks since Republicans disclosed their “unified framework.” The last major rewrite, passed in 1986, took two years.

The Senate hopes to follow with similar lightning speed, but with constant tweaking intended to appease wavering lawmakers, groups trying to analyze its impact are struggling to keep up. In other words, senators are scheduled to vote on a bill this week without knowing exactly how it’ll affect their constituents.

Amid this chaos, it’s easy to forget why regular Americans want tax reform in the first place. Research has shown that their most important gripe about taxes is the demoralizing feeling that the system is hopelessly complex and that other people are getting away with not paying their fair share. To use the president’s words, people think the “system is rigged.”

I’ve been researching and teaching tax policy for a dozen years, and I believe the Republican tax plan will only exacerbate that feeling.

More than math

Politicians and the media frequently talk about current efforts at tax reform as if this were a math problem.

Cut taxes for some groups, raise them on others and in the end hit a preordained target – in this case, US$1.5 trillion over 10 years. This framing assumes the only thing Americans care about is minimizing their own taxes – though, as it stands, many Americans may be surprised to find their taxes will go up under the GOP plan.

However, research by Brookings Fellow Vanessa Williamson reveals that Americans do not reflexively hate taxes. In fact, her research shows that most Americans view paying taxes as a moral responsibility and a fundamental act of citizenship.

What frustrates them, Williamson finds, is the tax system’s “deeply disempowering” complexity, the feeling that it was designed “with someone else in mind.” This resentful and defensive disposition is regularly reinforced when policy experts lament the public’s lack of knowledge about taxes, smugly reminding us, for example, that corporations don’t pay taxes, people do.

Tulane University economist Steven M. Sheffrin’s research sheds additional light on taxpayer anger. He focuses on the process of taxpaying, not just its outcomes. Taxpayers want to be treated with dignity and respect and have a voice in decision-making. They want to be able to look at various provisions of the tax code and decipher the underlying logic and justifications. They want to see the coherent and consistent application of a principle that defines one’s “fair share.”

Only 27 percent of those polled by Pew earlier this year were bothered “a lot” by how much they personally pay. Rather, they were bothered most by the feeling that particular groups such as corporations and the rich were not paying their fair share.

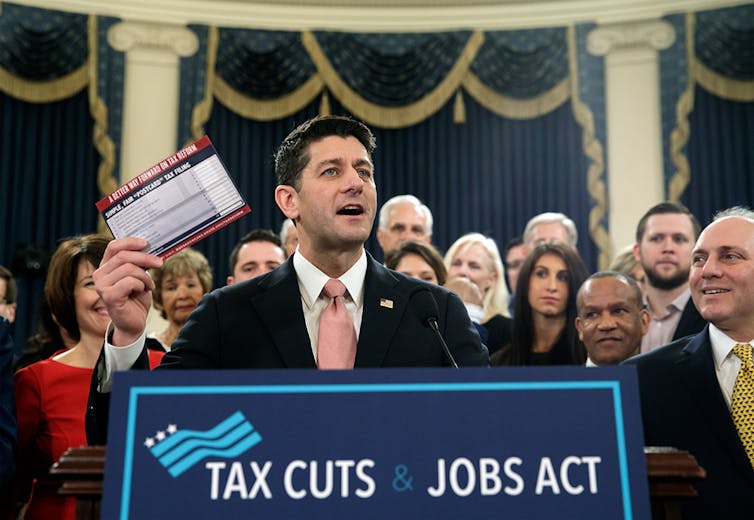

Republicans have sold their plan as a simplification of the tax code, eliminating loopholes and collapsing brackets, qualifying it as a “tax reform” not just a “tax cut.” But as Howard Gleckman of the Tax Policy Center has pointed out, the plan would “firmly maintain the basic structure of today’s tax code” and really is “a giant tax cut designed to benefit mostly businesses and high-income households.”

These proposed reforms address none of the taxpayers’ concerns about fairness.

Real tax reform

If Congress and President Donald Trump were serious about reforming the system so that taxpayers could actually feel good about it, they would do a number of things differently:

Eliminate complexity, not just replace old complexity with new. The postcard-size tax return prop has been making the rounds, but no one is falling for it. While the current proposals would rightly eliminate some layers of complexity such as the alternative minimum tax and widely abused corporate loopholes, most of the existing complexity would remain (loopholes for hedge fund managers, golf course owners and wealthy heirs among the most egregious). And new layers of complexity, such as special rules for pass-through businesses and offshore profits, would be created.

Acknowledge that we are using the tax system for a lot more than just raising revenue. Much of the complexity that people object to is a result of using tax breaks to fund non-tax-related policy goals. Political scientist Christopher Howard’s research about the “hidden welfare state” has shown how tax breaks are increasingly used to direct benefits to housing, education and a multitude of other policy areas. True tax reform would take stock of all of these provisions, determine whether they are achieving their intended goals and decide whether they should remain in the tax code. The GOP tax plan leaves most of these loopholes untouched.

Ensuring businesses pay their fair share. When it comes to politics, corporations insist that they are “people” with the right to speak or donate money as they wish. However, when it comes to taxes, corporations claim they aren’t people at all and therefore their taxes should be reduced as much as possible. Republicans made lowering the corporate tax rate a centerpiece of their plan. But companies can’t have it both ways. Given the benefits they receive – from political speech to legal protections and infrastructure – it’s only fair that companies share the burden like everyone else. True tax reform is about finding the right balance between helping businesses compete in the global economy and living up to their obligations to be good citizens and pay their fair share. The Republican plan addresses the first point and ignores the second.

Winners and losers

Instead of having an honest discussion about fixing a profoundly broken system, Republicans are pitting us against each other: rich versus middle class, capital versus labor, red states versus blue states, current Americans versus future generations.

And while we are distracted, fighting each other to be in the winners instead of losers column, they hope to pass exactly the bill they want: a $1.5 trillion gift to the wealthiest Americans.

Tax reform should be more than just a math problem. As long as we waste our energy fighting each other, we will never be able to create a system that makes us proud to pay our fair share.

And regular Americans will be left wondering: “Wasn’t this supposed to be about making the system simpler?”

Stephanie Leiser does not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

Read These Next

Hezbollah − degraded, weakened but not yet disarmed − destabilizes Lebanon once again

Hezbollah’s entry into the current war followed the killing of Ayatollah Ali Khamenei. The group has…

Trauma patients recover faster when medical teams know each other well, new study finds

A new study from a Pittsburgh hospital finds that trauma patients recover faster when emergency medical…

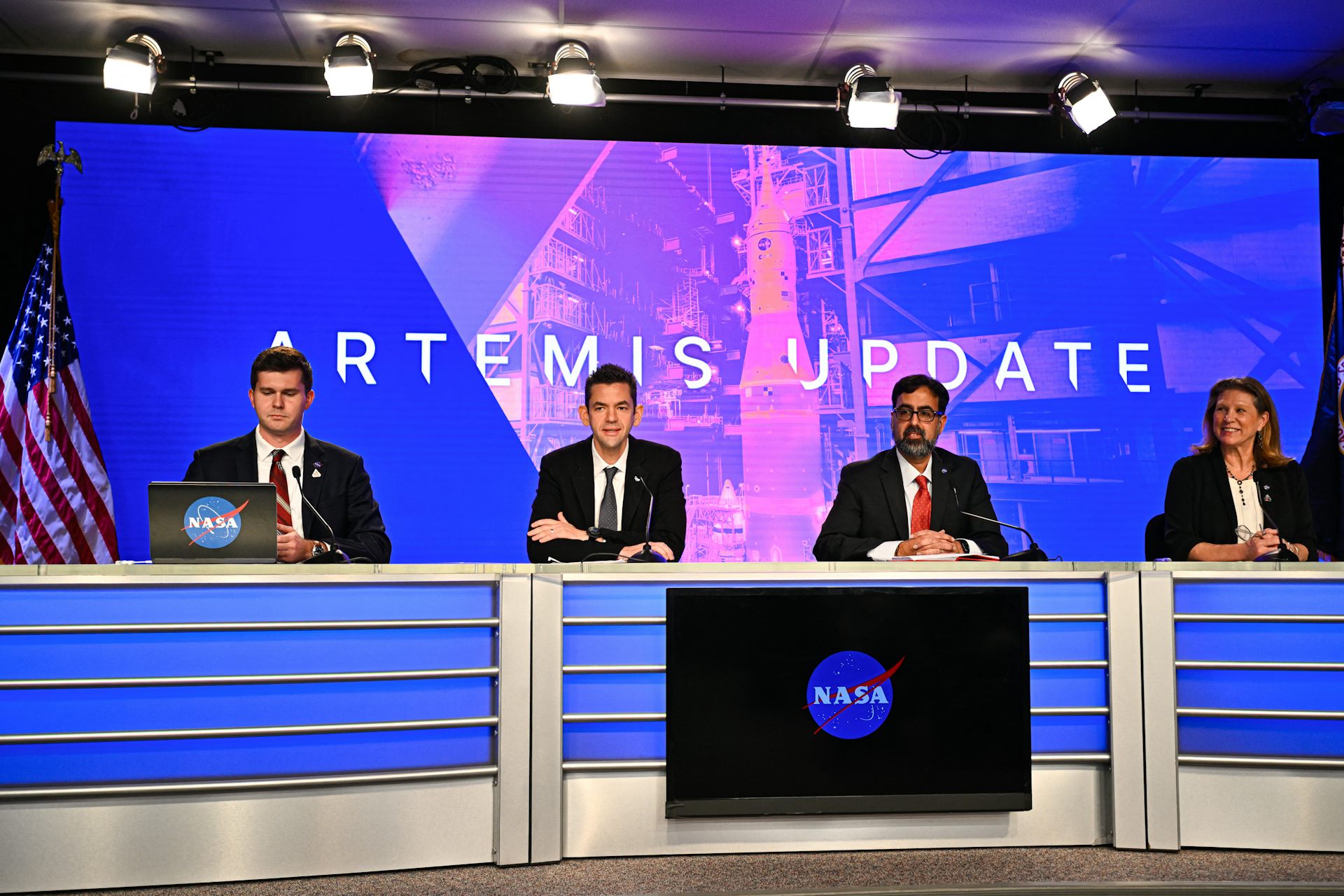

With Artemis II facing delays, NASA announces big structural changes to the lunar program

Artemis II has been plagued by similar issues to those faced by its predecessor, leading NASA to shake…