China's leverage over 'Rocket Man' is key to avoiding nuclear war in East Asia

The latest salvo of insults and threats between President Trump and North Korea's Kim brought the region a little bit closer to war. China, North Korea's closest trading partner, may be the only way out.

U.S. President Donald Trump and North Korean leader Kim Jong-Un are playing a dangerous game of brinkmanship while also trading personal insults.

Most recently, Trump blasted the “Rocket Man” in his inaugural speech to the United Nations, promising to “totally destroy” North Korea if it threatens the U.S. or its allies. The Trump Administration also added new sanctions aimed at strangling its ability to work with banks.

Kim, for his part, resorted to calling Trump “mentally deranged” and a “dotard,” while his foreign minister threatened to test a hydrogen bomb in the Pacific.

With tensions escalating, it is important to be realistic about how we can get out of this mess.

In short, any nonmilitary solution will rely on China choosing to apply its massive economic leverage over the North Korean regime. In a positive sign, China’s central bank recently told Chinese financial companies to stop doing business with North Korea.

Overall, however, it appears that China has increased its trade with North Korea in recent years while doing fairly little to forestall North Korea’s nuclear ambitions. China’s foremost objective seems to be promoting greater stability from its volatile neighbor, in part because it fears being faced with a massive humanitarian crisis should the regime collapse.

But while the poor quality of the data hinders a detailed analysis, a quick look shows just how much leverage China has, if it wishes to use it.

North Korea’s primary patron

In general, exports from one country to another can be mostly explained by the distance between them and the sizes of their markets, a pattern that holds for China and North Korea.

Geographically, they share a long border, which makes China a natural, though not inevitable, partner for trade. As a case in point, North Korea also shares a long border with South Korea, but these countries have almost no trade between them. In addition, North Korea shares a small border with Russia, with whom it has little, though ever-increasing, trade.

China’s large market, proximity and – most importantly – willingness to trade with North Korea has led to a situation in which North Korea has become highly dependent on trade with what has become its primary patron. About half of North Korean exports and imports go directly to and from China and most of the rest of its trade is handled indirectly by Chinese middlemen.

North Korea’s dependence on its neighbor has grown alongside China’s increasing economic dominance of East Asia, which gained momentum 15 years ago when China joined the World Trade Organization. Since then, both Chinese gross domestic product as well as its annual trade with North Korea have increased nearly tenfold, to around US$11 trillion and $6 billion, respectively.

North Korea imports nearly everything from China, from rubber tires to refined petroleum to pears, with no single category dominating. Meanwhile, coal constitutes about 40 percent of North Korean exports to China.

Time to use that leverage?

However, recent events – such as the use of front companies by Chinese firms to evade sanctions imposed on North Korea and China’s reluctance to cut off energy supplies to the country – have led to some uncertainty about the extent to which China is willing to use this economic leverage to rein in North Korea’s military ambitions.

On one hand, China previously claimed to have stopped coal imports from North Korea as part of recent efforts to punish the regime for missile tests and the suspected assassination of Kim Jong-nam, the estranged half-brother of North Korean leader Kim Jong Un. This was an important signal of China’s willingness to support U.S. concerns about the missile program since oil represents about a third ($930 million) of North Korea’s import revenue.

On the other hand, there is evidence that coal shipments in fact never ceased. And, in any case, China may have increased its imports of iron ore from North Korea to offset the lost coal revenues.

This is consistent with the idea that China carefully considers the resources and revenue that are available to the North Korean regime at any moment, and uses trade as a lever to control them. In this way, China walks a fine line between providing too many resources, and thus allowing the regime to prosper, and not enough resources, such that North Korea is in danger of collapsing. Ultimately, trade may be used as a lever to do some light scolding, but China’s overwhelming concern is preventing North Korea’s collapse.

Further evidence that China has tight control over the North Korean economy comes from a recent report from C4ADS. The research group found close, and often common, ownership ties between most of the major Chinese companies who do business with North Korea. This suggests that trade with North Korea is highly centralized and thus easily controlled.

Russia: North Korea’s other ‘friend’

China is not the only country that North Korea trades with, though the others currently pale in comparison. Other top export destinations include India ($97.8 million), Pakistan ($43.1 million) and Burkina Faso ($32.8 million). In terms of imports, India ($108 million), Russia ($78.3 million) and Thailand ($73.8 million) currently sell the most to North Korea.

Russia in particular may soon complicate U.S. efforts to isolate the regime. While still small, Russian trade with North Korea increased 73 percent over the first two months of 2017 compared with the same period of the previous year.

But whereas China is legitimately worried that an economic crisis in North Korea could lead to a flood of refugees or all-out war, Russia likely sees engagement with North Korea in much simpler terms, namely as an additional way to gain geopolitical advantage relative to the U.S.

A way out?

Nearly all experts agree that there is no easy way to “solve” the North Korea problem. However, one plausible approach is to encourage South Korea and Japan to begin to develop nuclear weapons programs of their own, and to only discontinue these programs if China takes meaningful steps to use its trade with North Korea to reign in the regime.

Threatening to introduce new nuclear powers to the world is clearly risky, however stable and peaceful South Korea and Japan currently are. But China is highly averse to having these economic and political rivals acquire nuclear capabilities, as it would threaten China’s ongoing pursuit of regional control. In short, this is a sensitive pressure point that could be used to sway the Chinese leadership.

One way or another, China must become convinced that the costs of propping up the North Korean regime through trade are higher than the costs of an increased probability that the regime will collapse.

This is an updated version of an article originally published on July 6, 2017.

Greg Wright does not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and has disclosed no relevant affiliations beyond the academic appointment above.

Read These Next

Hezbollah − degraded, weakened but not yet disarmed − destabilizes Lebanon once again

Hezbollah’s entry into the current war followed the killing of Ayatollah Ali Khamenei. The group has…

Congress once fought to limit a president’s war powers − more than 50 years later, its successors ar

At the tail end of the Vietnam War, Congress engaged in a breathtaking act of legislative assertion,…

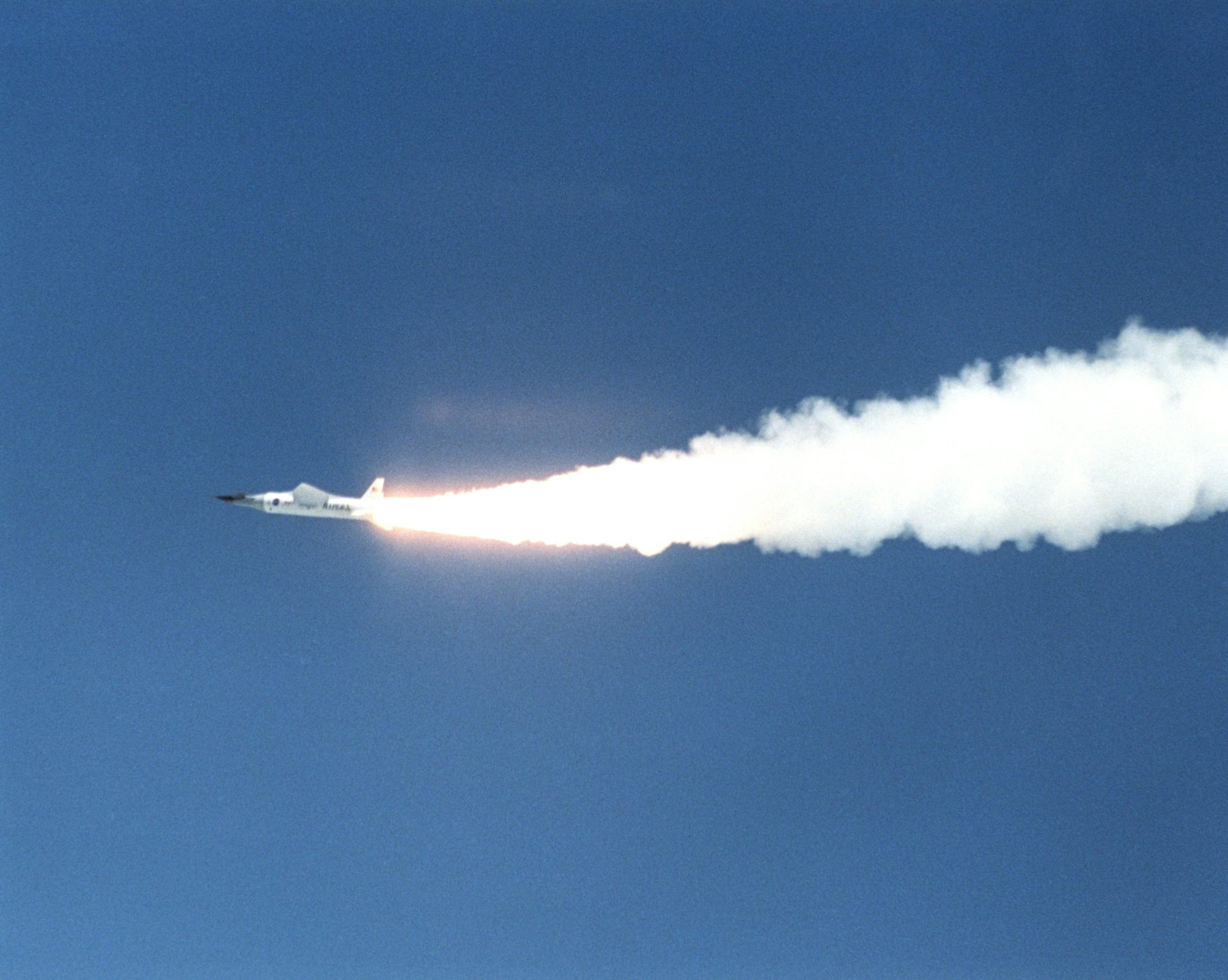

With Artemis II facing delays, NASA announces big structural changes to the lunar program

Artemis II has been plagued by similar issues to those faced by its predecessor, leading NASA to shake…