Taxes are due even if you object to government policies or doubt the validity of the 16th Amendment’

Some people refuse to file tax returns or pay all of their income tax due to moral or ethical concerns. The IRS warns that they, like more selfish tax scofflaws, may face penalties.

Most Americans don’t like doing, or paying, their income taxes. But every year, about 85% of them will voluntarily pay the full amount of the taxes they owe.

Even so, the IRS estimates that it loses over US$400 billion of revenue each year because people fail to file their taxes, underreport their income or underpay the amount of taxes they owe.

Most of these losses are the result of deliberate tax evasion schemes designed to fatten unscrupulous taxpayers’ own pockets. But some people take a less greedy and more principled view: They refuse to file tax returns or pay all of their tax due to moral or ethical concerns. In essence, they view a decision to not pay income taxes as a form of civil disobedience.

While the government has not released much data about these people, in the late 1990s, it estimated that 47,000 of them owed approximately $540 million in federal income taxes.

As a tax professor and scholar of judgment and decision-making, I categorize people who do not pay taxes due to moral or ethical concerns into one of two buckets, which I call “tax deniers” and “tax protesters.” While their motives may differ, the government and courts tend to respond to them in a similarly unfavorable manner.

Tax deniers

The first group includes people who deny that the government has a right to levy income taxes. These so-called tax deniers are legally and morally opposed to filing tax returns and paying taxes due to their mistaken belief that taxes are unconstitutional or otherwise invalid.

Tax deniers make numerous arguments, none of which has been accepted by courts or the IRS. For example, some tax deniers believe that the 16th Amendment to the Constitution, which grants Congress the power to collect income taxes, was never properly ratified. They note that the text of the amendment, which was ratified in 1909, differed from the text originally proposed by Congress because it included differences in spelling, capitalization and punctuation.

Others argue that federal income taxes are illegal because they violate the Fifth Amendment, which prohibits the government from taking private property without due process of law.

Tax deniers use a wide variety of methods to avoid paying taxes. Some simply refuse to file tax returns, while others engage in complicated schemes using offshore trusts to hide income from the government.

Tax protesters

Unlike tax deniers, tax protesters do not deny the government’s right to levy taxes. Rather, they refuse to pay some or all of their taxes in order to protest government-funded policies and programs that are inconsistent with their moral and ethical beliefs.

Common examples of government spending they object to include military spending and medical research.

Tax objectors date back to the American Revolution when Quakers refused to pay taxes to the colonial governments for military purposes. In the 1960s, public figures such as Joan Baez and Gloria Steinem withheld payment of their federal income taxes to protest the government’s participation in the Vietnam War.

Many tax protesters do file accurate tax returns but refuse to pay some or all of the tax due. For example, some war tax protesters determine the percentage of income tax revenue that goes toward military spending and then hold back that percentage of their tax while paying the rest. Groups such as the War Resisters League provide protesters with information to help them decide how much to withhold. For 2025, the group expects that 45% of government spending will go to the military and suggests that people withhold that proportion of the total tax they owe.

In some cases, protesters redirect the taxes they do not pay to one or more charities. Other tax protesters adopt an approach more within the law, deliberately earning as little as possible so that their income falls below the level required to file a tax return.

The government’s response

Unsurprisingly, the IRS disagrees with the arguments made by both kinds of objectors. The agency has stated repeatedly that a taxpayer does not have the right to refuse to pay taxes based on religious or moral beliefs.

The IRS also warns that taxpayers who engage in this type of civil disobedience should expect to pay a price – including fines, penalties, interest and potential criminal prosecution. The IRS also has the authority to garnish a taxpayer’s wages and other property to pay off any unpaid tax liability.

Like all citizens, tax deniers and tax protesters have the right to appeal any action taken against them by the IRS. However, even going back as far as the 1800s, courts have repeatedly held in favor of the government, taking the position that liability for taxes does not depend on whether a taxpayer agrees with government programs or policies.

For example, in the 1860s, a Massachusetts suffragette refused to pay property taxes unless women were given the right to vote. The Massachusetts Supreme Court ordered her to pay, and when she continued to refuse, authorities seized and sold her property to cover the unpaid taxes.

During the Vietnam War, the U.S. government placed liens on the property of celebrities who refused to pay taxes that would be used to help fund the war.

Even more recently, actor Wesley Snipes went to trial in 2008 after arguing that he was not obligated to pay income taxes and saying the government extracts taxes from its citizens illegally. Snipes was convicted on misdemeanor charges of willful failure to file federal income tax returns and was sentenced to three years in prison. After an unsuccessful appeal, he served 28 months.

Objecting to income taxes is not, in and of itself, a criminal offense. But not actually paying them is a different matter. That opens people up to the risk of paying financial penalties, having their wages garnished and serving jail time.

Michele Frank does not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

Read These Next

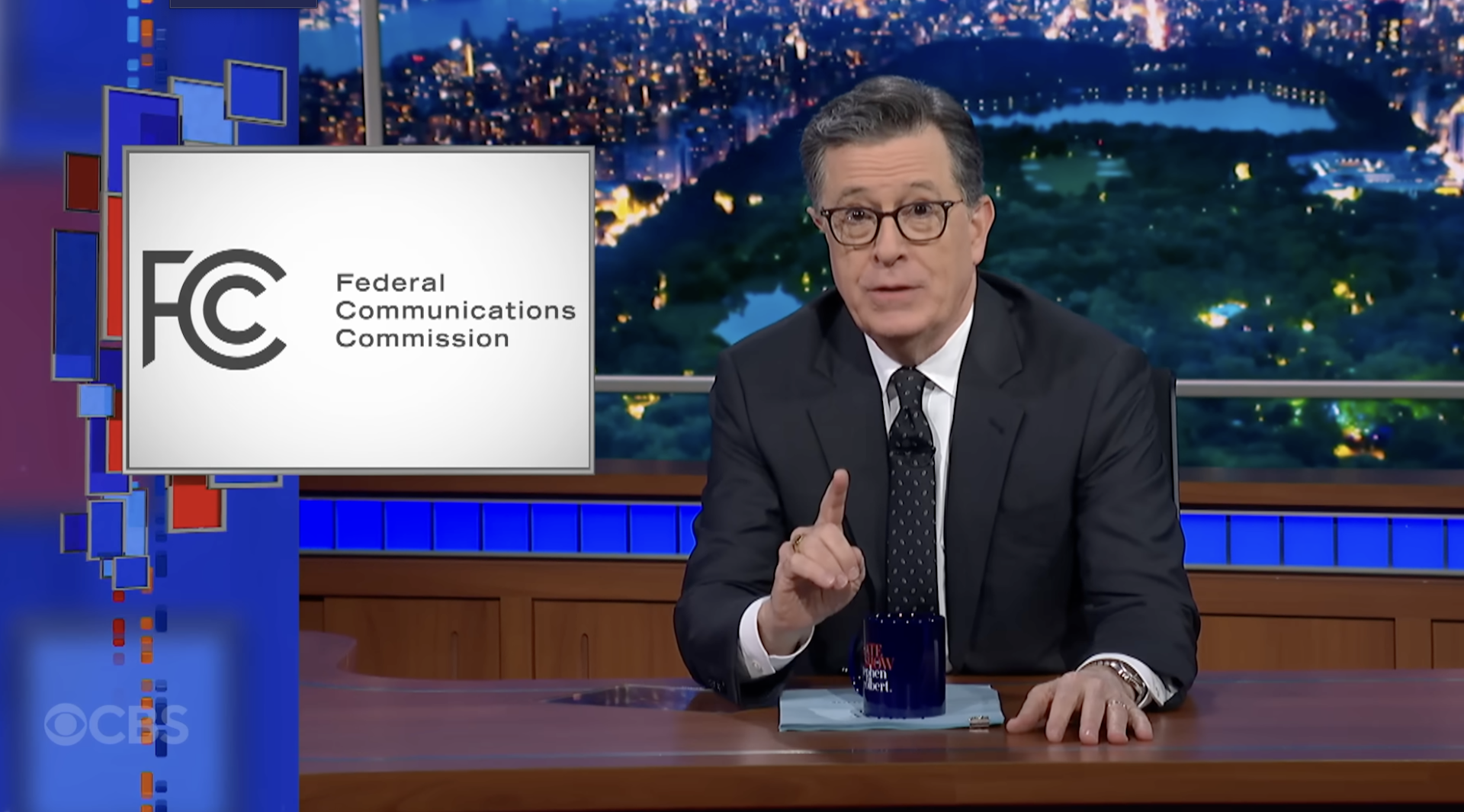

Why Stephen Colbert is right about the ‘equal time’ rule, despite warnings from the FCC

The ‘equal time’ rule has been around for a century and aims to promote broadcasters’ editorial…

As war in Ukraine enters a 5th year, will the ‘Putin consensus’ among Russians hold?

Polling in Russia suggests strong support for President Vladimir Putin. Yet below the surface, popular…

Supreme Court rules against Trump’s emergency tariffs – but leaves key questions unanswered

The ruling strikes down most of the Trump administration’s current tariffs, with more limited options…