When envisioning the future of TV, think of a shopping mall

Disney recently announced a forthcoming streaming service, leading some to wonder if the company is gearing up for a battle with Netflix. But not all streaming services are locked in a death match.

One of the biggest media industry stories this year is Disney’s announcement that it will launch its own internet-distributed television service in 2018.

There’s a lot we don’t know. The price is up in the air. And Disney – a company that owns everything from Star Wars to Marvel to ESPN – hasn’t clearly signaled how it will divvy its major franchises and brands across two or more services.

But much of the prognosticating – especially those betting on a battle between Disney and Netflix – reveals a misunderstanding of the marketplace.

Don’t assume internet-distributed video will be dominated by a single service, or that all video services compete against each other. Instead, Disney’s new streaming service points to the growing range of offerings consumers will be able to choose from in the coming months and years.

There’s room for multiple winners

Disney, for example, recently suggested one of its new services would include only family-friendly content and would be priced “substantially lower” than Netflix.

But is that service a threat to Netflix, as some have suggested? Of course not.

It helps to think of new television streaming services as specialty stores like the Gap, Chico’s or Justice. All sell clothing, but they compete minimally with one another because each targets consumers of different ages.

Likewise, while a department store such as Macy’s might compete a bit with each of these stores, they’re primarily concerned with other retailers that house many goods under the same roof – Target, Walmart and J.C. Penney. Even in a world of online retailers, there’s a huge variety among specialty sellers and Amazon’s one-stop shopping.

When it comes to streaming services, they might all deliver the same thing – video – via an internet connection. But it’s important to understand that all video services are not in competition. Many are quite complementary. Most offer completely different libraries of content and instead compete with cable and satellite packages. A Disney service would replicate only a small part of Netflix’s library, and would likely include much of the content offered on the Disney Channel.

Consumers with young children may decide that they need only a service with content for kids. Or they may decide they want a single library with content for both adults and children. Or they may decide that each provides enough value to subscribe to both.

Internet-distributed television simply offers much more flexibility; it’s up to consumers to assess what they want and how much they want to spread their spending.

In addition to differences based on the type of content these services offer, their revenue models are also distinct. Contrast YouTube and Netflix. YouTube – like other social media platforms – has low content costs because users create and upload most videos. Without substantial program costs, YouTube can develop a business supported through advertising.

In contrast, Netflix offers a deliberately curated library of content that it either pays to license or creates. It provides a library valued enough by some to pay a monthly fee for access to it. Because of the difference in their revenue models and the content those models allow, Netflix and YouTube are far more complementary than competitive.

The breakdown of channel bundles

For decades, U.S. television viewers could choose from only two or three options: broadcast signals, an expensive cable or satellite bundle, or a bigger, even more expensive cable or satellite bundle.

People frustrated with bundles (“Why would I want all of these channels?”) used to call for “à la carte” cable: the ability to select individual cable channels for which they hoped to pay less than the high amount for a bundle with many channels they never viewed.

Of course, there was a reason companies didn’t let customers pay less for fewer channels – the bundles are the result of a business strategy intended to maximize profits.

But even though traditional cable remains bundled, more and more entertainment companies – like Disney – are offering their content at a standalone fee, allowing consumers to cobble together a customized menu of services. When viewers decide whether to subscribe to Disney’s new service, they’ll think about how this added cost relates to what they’re already paying, and whether it’s worth it.

We’re still in the early days of this new way of delivering television and film. For every headline announcing a service shutting down, new ones are launching. And FCC plans to eliminate net neutrality will likely change this landscape tremendously.

It’s all part of the process of companies figuring out how much consumers want and how much they’re willing to pay. The new services offering content geared to a brand, franchise or genre – Disney, WWE Network (wrestling), Shudder (horror) – never plan on being in every home in the way CBS and NBC once were.

Just as we sometimes choose the one-stop shopping of Target, services such as Netflix offer convenience. But the trade-off for convenience is product choice – do you want to select among two sweaters or the 20 you’ll find at Old Navy?

Services that fail don’t portend the viability of all internet-distributed television. Nor do the successes. Rather, they simply offer lessons on particular value propositions.

The future likely includes a mix of specialty and multifaceted services.

Amanda Lotz does not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

Read These Next

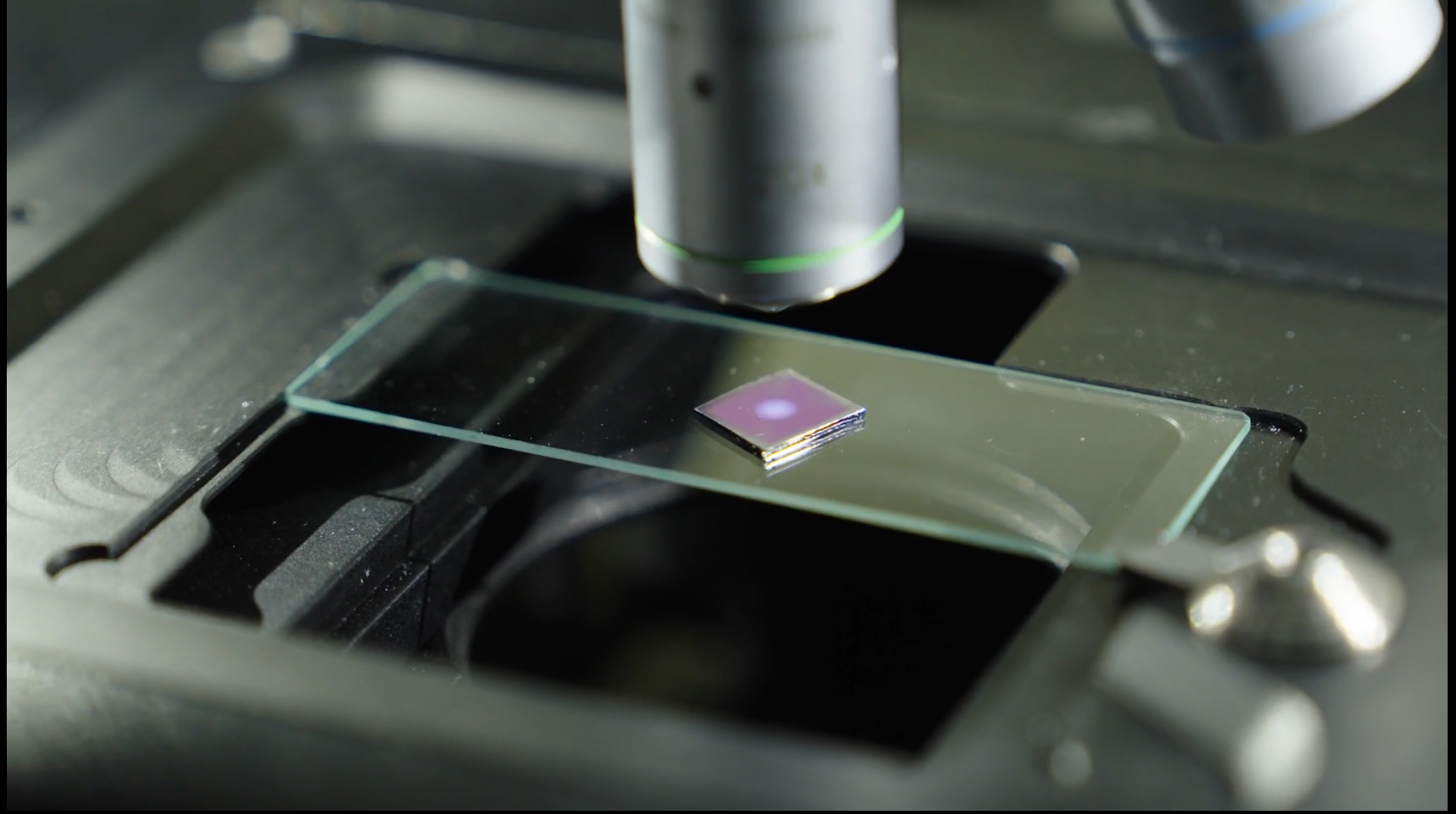

Nanoparticles and artificial intelligence can help researchers detect pollutants in water, soil and

Tiny particles bounce light around in a unique way, a property that researchers are using to detect…

How natural hydrogen, hiding deep in the Earth, could serve as a new energy source

Hydrogen demand around the world is projected to grow significantly by 2050. Some of that supply could…

Minneapolis united when federal immigration operations surged – reflecting a long tradition of mutua

Minnesotans from all walks of life, including suburban moms, veterans and protest novices, have bucked …