Private equity firms are snapping up mobile home parks − and driving out the residents who can least

For residents who can’t afford to move, rising lot rents can mean losing everything.

One of America’s most affordable paths to homeownership is slipping away.

At manufactured home parks – sometimes called trailer parks or mobile home parks – rents are rapidly rising due to large-scale buyouts by private equity firms.

Although private equity’s foray into the housing market is not new, the buyout of mobile home parks by investment firms is on the rise – with devastating consequences for residents. Over the past decade, rents in these parks have risen 45%, according to census data. Once a park is sold, the risk of eviction rises significantly in the following year.

I’m a poverty law attorney in Virginia, and many of my clients are residents of mobile home parks. Over the past four years, I’ve watched their communities get sold, one by one, to large investment firms. Many of them are desperately struggling to protect their homes – for some, their only source of wealth – in the face of exploding rents and threats of eviction.

The immovable mobile home

Today, the term “mobile home” is a misnomer.

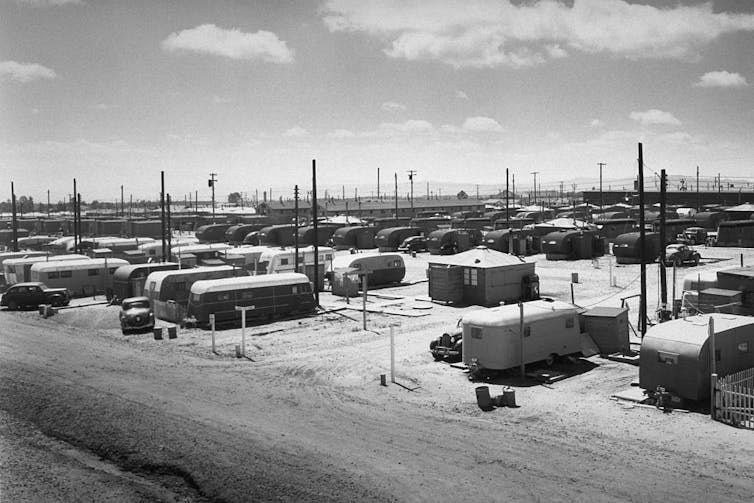

Historically, mobile homes were trailers designed for travelers and workers living near factories. With so many veterans returning home after World War II, trailers provided an easy and affordable way for them to obtain housing in the face of shortages. The trailers could be moved from place to place as people either attended school or sought work.

A shift occurred in the 1950s. Those with higher incomes bought houses, and those with less means continued to live in mobile homes. Eventually, mobile home communities cropped up throughout the country as places for people to park their mobile homes for months, years or permanently.

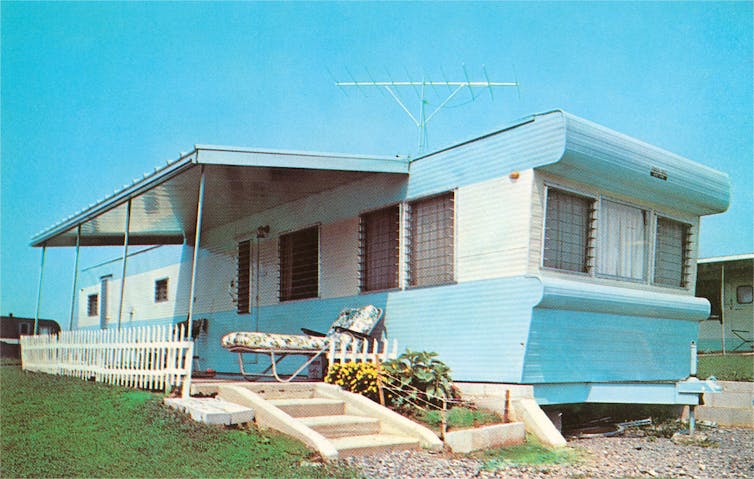

Nowadays, mobile homes are more often called “manufactured homes.” They are assembled in factories and rarely move once they’ve been purchased and settled. In fact, more than 90% of manufactured homes never move from their original site.

Today, around 20.6 million Americans live in a mobile or manufactured home. About one-third of mobile homes are located in mobile home communities.

In these communities, the residents usually own the home itself, but they rent the lot that the home sits on. They are responsible for the upkeep of their home, but the park owners are responsible for park infrastructure, including street maintenance and sewage systems.

Although many Americans still think of these homes as mobile, they’re prohibitively expensive to move. Many have had the wheels or hitches removed years ago. Additionally, many owners of trailers or manufactured homes have invested in additions, such as porches or extra rooms, that have made these homes even more difficult to relocate.

Private equity swoops in

According to the National Low Income Housing Coalition, no state has enough affordable housing for those with the lowest incomes.

In the midst of a housing affordability crisis, mobile homes are seen as a way for those with limited incomes to generate wealth and access homeownership. Indeed, over half of all manufactured homeowners earn less than US$50,000 a year, and one-third are over age 60.

However, this type of homeownership is becoming more difficult to maintain for many due to the increased buyout of mobile home parks by large investment firms – a trend that mirrors the rest of the housing market.

Increasingly, housing is being treated as a commodity rather than an essential social good – what’s sometimes called the “financialization of the housing market.”

For private equity firms, housing has been a fruitful investment. But in order to maximize returns on their investments, they usually increase rents and cut costs. Company leadership is often totally divorced from their tenants; instead, they hire on-site and regional managers who exercise disproportionate control over evictions and rule enforcement. Overall, this financialization has transformed the way those with limited incomes are able to obtain shelter – including the owners of mobile homes.

In the past, manufactured home communities were largely “mom-and-pop” enterprises. Though they were still subjected to abusive practices, tenants usually knew their landlords and saw them often, and rents were much more stable.

In 2020 and 2021, institutional investors accounted for 23% of all manufactured home park purchases, up from 13% between 2017-2019. Now, 23 private equity firms own over 1,800 parks in the U.S.

Once bought, lot rents usually begin rising. Mobile home park residents are especially vulnerable due to their circumstances: Since their homes are so difficult to move, they are essentially trapped when faced with rising lot rents. One study of Florida mobile home communities found that in the months after a park sale, eviction filings increased by 40%. Residents often find themselves forced to choose between paying exorbitant costs to move their home or paying unaffordable lot rents.

State laws put the squeeze on tenants

Because they’re so unique, manufactured home communities are often governed by a special set of state laws.

In my state, Virginia, the Manufactured Home Lot Rental Act covers rules that park owners and residents must follow. If someone is evicted for failing to pay their lot rent, they still own their home but can no longer live in the park.

Often, states impose short time frames for someone to move their home following an eviction. In North Carolina, for example, a tenant has just 21 days to remove the manufactured home from the park following an eviction judgment. In Virginia, a homeowner has 90 days after being evicted to move or sell their mobile home, but they must continue paying rent during that time.

In many states, if a resident fails to move their home in time, the park owner may repossess the home or move it. Even if the resident lives in a state that continues to protect ownership of the mobile home against park owners, it is often difficult to enforce, as park owners may now have a lien on the mobile home for any amount the resident owes. The result is that many residents who are evicted lose their home.

Putting power back in the hands of residents

Currently, only 22 states have laws that require advance notice to residents of park sales. Most simply provide a timeline for owners to inform park residents of their intent to sell.

Nonetheless, many states are coming up with strategies to keep residents from being forced out and help them assume ownership of the parks.

Recently, Maine passed a law that gives park residents a right of first refusal if their park is up for sale. The law also levies a fee for out-of-state investors who buy parks, which can put residents in a better position to purchase the parks where they live.

In other cases, residents have banded together to buy the park by forming a cooperative with external support. They then apply for financing and purchase the park. Resident Owned Communities USA is one example of an organization that works to support resident ownership in manufactured home parks.

Many advocates are also pushing for rent control policies in mobile home parks, limiting the amount that new owners can raise rents annually. In 2019, New York state passed a law limiting annual rent hikes in mobile home parks to 3%, though this can climb to 6% annually in certain circumstances.

Additional solutions include limiting evictions to narrow circumstances, tightening lot lease contracts to give residents additional protections and strengthening zoning rights for existing mobile home parks.

In my practice, I see park residents eager to maintain their long-standing homes and communities in the face of outside investors and unresponsive local governments. But until these solutions are widely adopted, residents will continue to lose their wealth – and with it, this crucial path to homeownership.

I represent tenants facing eviction from mobile home parks, as well as tenant associations in mobile home parks advocating against displacement.

Read These Next

Taboo tics like shouting curses and slurs are uncommon in Tourette syndrome − but people who have th

Obscene language tics, called coprolalia, don’t reveal what people with Tourette’s think and feel.…

Why ICE’s body camera policies make the videos unlikely to improve accountability and transparency

For body cameras to function as transparency tools, wrongdoing would have to be consistently penalized,…

Honoring Colorado’s Black History requires taking the time to tell stories that make us think twice

This year marks the 150th birthday of Colorado and is a chance to examine the state’s history.