‘The Amazon of Sports’ has already cornered baseball’s apparel market – and is now on the verge of s

Fanatics’ consolidation of the sports card industry risks a stagnant future for the hobby.

During spring training, Major League Baseball’s official uniform supplier, Fanatics, became a focal point for all the wrong reasons.

After arriving in Florida and Arizona, players began to complain about the quality of their new, Fanatics-manufactured uniforms.

One player for the Baltimore Orioles groused that the new uniforms looked “like a knockoff jersey from T.J. Maxx.” Others were dismayed to learn that the white pants were transparent, with seams from tucked-in jerseys – and sometimes more than just seams – visible to all.

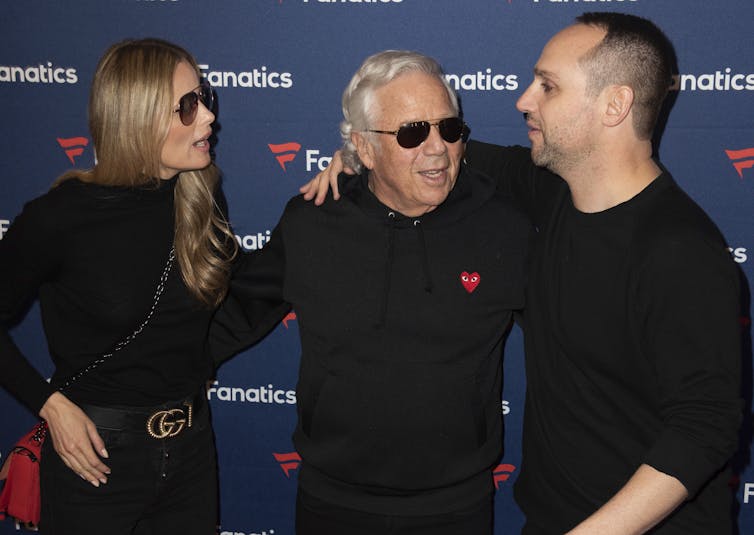

The spring training uniform fiasco has led to more scrutiny for Fanatics, a company that had, until recently, been widely considered an American success story. CEO Michael Rubin, a college dropout, grew Fanatics from a ski and snowboard business into what some now call “the Amazon of Sports.”

Thanks to its connections with the leading U.S. sports leagues, Fanatics has quickly become the dominant player in nearly every aspect of the sports licensing industry. It manufactures and sells everything from team hats and T-shirts to logo-adorned license plate frames and birdhouses.

But uniforms are not the only aspect of Fanatics’ licensing strategy that has elicited controversy. Over the past few years, Fanatics has undertaken an aggressive campaign to acquire the exclusive rights to produce the officially licensed sports trading cards for not only MLB but also the NFL and NBA. In some cases, these deals are set to run for as long as 20 years.

As we explain in a forthcoming article in the University of Illinois Law Review, Fanatics’ consolidation of the sports card industry threatens to reduce the company’s incentive to innovate or invest in trading cards, risking a stagnant future for the hobby.

Pro sports get exclusive

In order to produce apparel or memorabilia featuring official team logos, manufacturers must secure the legal right to use the teams’ trademarks, the intellectual property that legally protects teams’ names and emblems.

The companies will typically acquire these legal rights by entering into contracts, called licensing agreements, with a particular sports league, giving the manufacturer the right to use all league and team logos on its products.

Historically, U.S. sports leagues have granted multiple companies these rights.

In recent years, however, leagues and manufacturers have tended to favor exclusive licenses – agreements that ensure that only a single company will have the right to use the league’s trademarks on a particular type of product. EA Sports, for instance, has held the exclusive rights to produce NFL video games – via its Madden franchise – for nearly 20 years, giving it an effective monopoly over this product line.

After deciding to move into the sports trading card market, Fanatics used exclusive trademark licenses to secure the sole rights to produce MLB, NFL and NBA cards in 2021.

While some people may see baseball cards as mere child’s play, the U.S. sports card industry is estimated to be a US$12 billion market. Since the COVID-19 pandemic, there’s been a surge in interest.

Moving forward, Fanatics will have near monopoly control over a large chunk of that market.

Trading card competition spurs innovation

This won’t be the first time that the U.S. sports card hobby has fallen under the control of a single manufacturer.

Throughout the 1960s and 1970s, one of the companies recently displaced by Fanatics – the Topps Chewing Gum company – possessed largely unchallenged power over the industry.

Topps had acquired its monopoly in the mid-1950s after buying out its former competitor, Bowman, following a protracted legal battle. It then maintained the monopoly for decades by signing exclusive contracts with nearly every MLB player. These contracts gave Topps the sole rights to use images of the players on trading cards.

This lack of competition resulted in an era that featured little innovation – and, in the eyes of many collectors, uninspired offerings. Indeed, during this period, Topps would not only often rely on relatively unattractive card designs, but the company would also occasionally reuse the same player photos multiple years in a row.

The Topps monopoly was ultimately broken up by a federal court in a suit filed by would-be competitor Fleer under the Sherman Antitrust Act, and this decision led to a variety of new brands entering the market.

In addition to Fleer, the 1980s would witness the launch of a flood of new card companies, including Donruss, Score and Upper Deck. The resulting competition pushed these companies, with Upper Deck leading the way, to dramatically improve their product offerings, not only upgrading their card designs and photos, but also their printing technology and card stock.

Eventually, however, many card collectors became overwhelmed by the vast number of product offerings in the 1990s and early 2000s. Realizing that overproduction was dampening consumer interest, sports leagues began to grant exclusive licenses to individual card manufacturers to restrict the number of cards on the market. Topps, for instance, regained its status as the exclusive card manufacturer for MLB in 2009.

Until recently, however, different companies had held the exclusive rights to produce trading cards for the leading U.S. sports leagues, providing some degree of continued competition in the industry.

Is Fanatics running afoul of antitrust law?

Fanatics’ consolidation of the industry raises the specter that the hobby could once again witness the ills of monopolization in the coming years.

Perhaps unsurprisingly, Fanatics’ takeover of the sports card hobby is currently being challenged in court by Panini, another of the companies that Fanatics supplanted.

The lawsuit alleges that Fanatics has violated the Sherman Antitrust Act by engaging in anti-competitive practices that have ousted Panini and other competitors from the industry.

In this sense, Fanatics’ re-monopolization of the U.S. sports trading card business exhibits additional parallels to the earlier Topps monopoly of the 1960s and 1970s.

Ultimately, Panini’s case merely underlies what may actually be bigger questions about Fanatics’ business practices in general.

Fanatics has used exclusive license agreements – similar to those that it has executed for sports cards – to help build its dominant position in the broader sports licensing marketplace.

Whether these exclusive licensing agreements are legal or not remains unresolved; the permissibility of similar exclusive trademark licenses under federal antitrust law was last raised in a 2010 case before the Supreme Court in American Needle, Inc. v. National Football League.

In that case, a former manufacturer of NFL hats sued the NFL after the league decided to grant Reebok the exclusive rights to make its team-logoed hats beginning in 2002. American Needle alleged that the decision by 32 individually owned and operated NFL franchises to collectively license their trademarks to a single manufacturer ran afoul of the Sherman Antitrust Act.

While the Supreme Court held that the NFL-Reebok deal was subject to scrutiny under antitrust law, the parties ultimately settled the case before the courts issued a final resolution regarding the legality of the NFL’s exclusive license.

While sports trading cards comprise a multibillion-dollar industry, they represent just a share of the larger, $33 billion U.S. sports licensing market.

See-through, cheap-looking baseball pants may or may not be a consequence of a lack of competition in this market.

But we think it’s only a matter of time before the depletion of competition for licensed sports apparel results in higher prices and less choice for fans. The same holds true for trading cards.

The authors do not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and have disclosed no relevant affiliations beyond their academic appointment.

Read These Next

Why US third parties perform best in the Northeast

Many Americans are unhappy with the two major parties but seldom support alternatives. New England is…

50 years ago, the Supreme Court broke campaign finance regulation

A gobsmacking amount of money is spent on federal elections in the US. The credit or blame for that…

As war in Ukraine enters a 5th year, will the ‘Putin consensus’ among Russians hold?

Polling in Russia suggests strong support for President Vladimir Putin. Yet below the surface, popular…