Historic tax overhaul nears finish line: 5 essential reads

The tax bill that just cleared the Senate contains sweeping changes to nearly every facet of American life.

Editor’s note: The following is a roundup of stories The Conversation has published on the GOP’s sweeping 2017 tax bill.

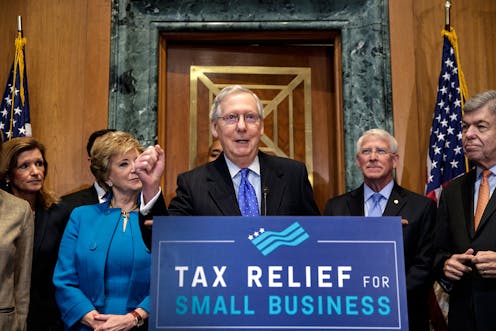

The Senate’s passage of the Republican tax plan on a party-line vote on Dec. 2 means the most significant overhaul of the U.S. tax code in a generation may be just days away from becoming the law of the land. All that remains is reconciling the Senate’s version with the one passed by the House in mid-November, a couple of additional votes and the president’s signature.

The Senate bill’s nearly 500 pages, some aspects of which were handwritten in the margins within hours of the 2 a.m. vote, contain changes that will greatly affect every facet of the economy, from health care to higher education and housing.

1. Sickness and the economy

Under the Affordable Care Act’s individual mandate, Americans must buy health insurance or face a penalty. But the Senate’s tax bill would eliminate this rule. According to the Congressional Budget Office, that will lead to 13 million more uninsured Americans by 2027.

That’s bad for the economy, says Diane Dewar, who studies health policy at the University at Albany, SUNY. When people don’t have health insurance, they’re more likely to get sick and miss work. They also may wait to go to the doctor until it’s absolutely necessary, racking up bills for uncompensated care that end up being absorbed by hospitals, insurance companies and others.

“If Americans become less healthy and have less access to health care,‘ she argues, "then everyone loses.”

2. An attack on higher education

The tax plans passed by the House and Senate contain several provisions that would have a big impact on universities and students alike, such as a tax on university endowments and changes that could significantly increase taxes for some students.

Benjamin Cohen, a professor of international political economy at the University of California, Santa Barbara, explains how these “appalling” provisions “will have adverse economic effects that will be both substantial and long-lasting.”

“Many schools will see their budgets cut,” he continued. “Faced with higher fees and tuition, many students will be forced to drop out – their dreams shattered, their earning potential stunted, their contribution to the American economy significantly curtailed.”

3. It’s not a popularity contest

So will voters punish Republican lawmakers for passing such an unpopular bill during next year’s midterms?

David Barker, director of the Center for Congressional and Presidential Studies at American University sees the opposite – positive outcomes for incumbents.

“Nothing is more central to Republican orthodoxy than tax cuts for the wealthy,” Barker writes. “If Republican lawmakers hadn’t gotten this done now, while they had the chance, they could have expected donors to ignore their calls next year.”

Of course, passage of the law was also a win for the president – and may help him win reelection in 2020.

“And if Trump wins reelection, everything else that we associate with his candidacy and his presidency may be validated and copied by future politicians, on both sides, as 'the way to win,’” Barker concludes, “leaving a political legacy that may far outlast the consequences of this tax bill.”

4. Tax ‘reform’?

Many refer to the Republican tax plan as a “reform” that will make the tax code simpler.

Taxpayers do want reform – just not the kind in the bills that just passed the House and Senate, argues Stephanie Leiser, a lecturer in public policy at University of Michigan.

“Research has shown that their most important gripe about taxes is the demoralizing feeling that the system is hopelessly complex and that other people are getting away with not paying their fair share. To use the president’s words, people think the ‘system is rigged.’”

The Republican plan, she writes, “will only exacerbate that feeling.”

5. ‘Dire’ impact on affordable housing

You might not expect a tax plan to have a big affect on the supply of affordable housing, yet Georgetown research fellow Michelle D. Layser explains how it will do just that.

“The supply of affordable housing is so low that there is no state, city or county in the country where a full-time minimum wage employee can afford to rent a two-bedroom unit,” she wrote. “These housing woes are sure to become more dire.”

Read These Next

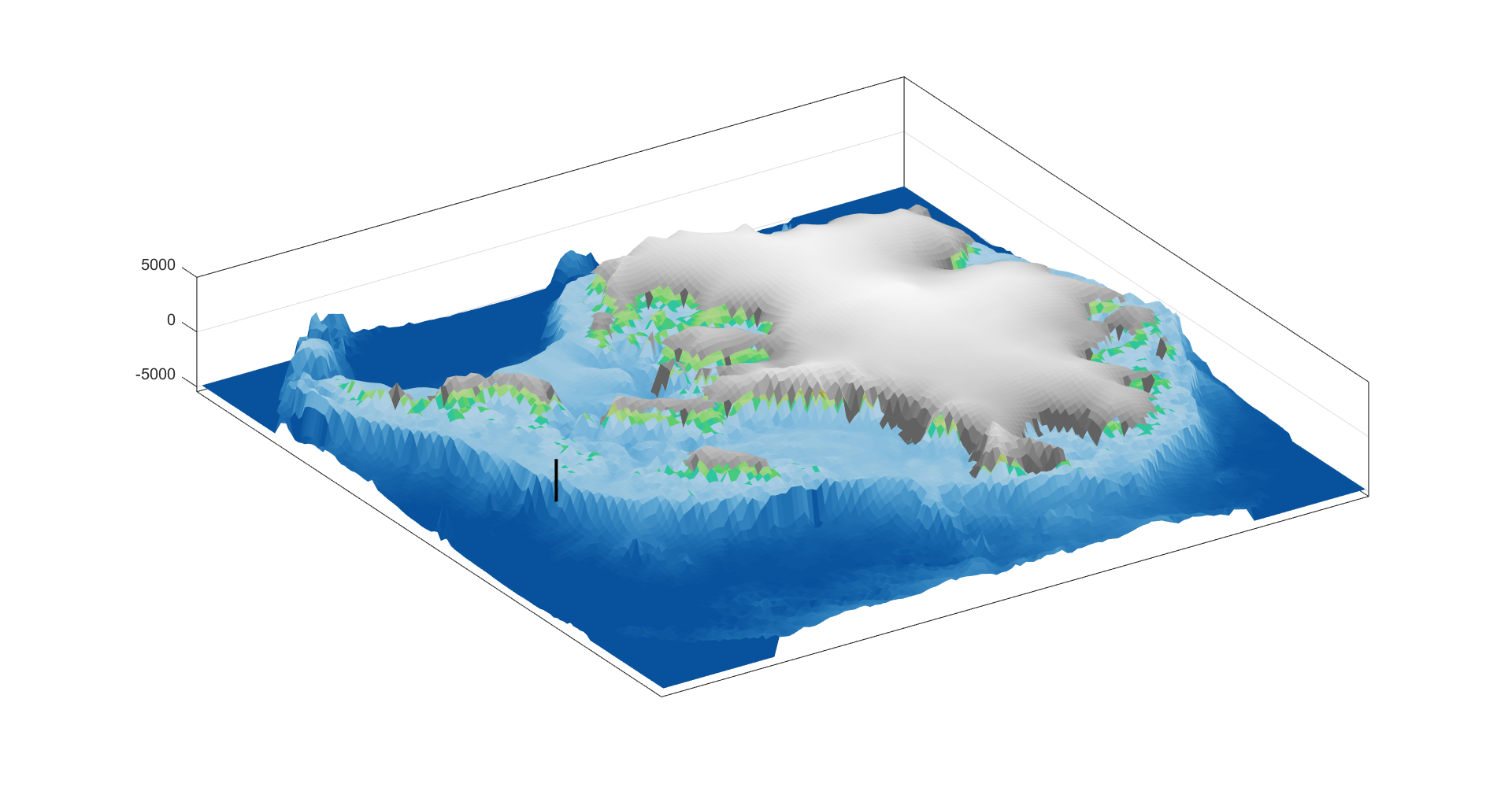

West Antarctica’s history of rapid melting foretells sudden shifts in continent’s ‘catastrophic’ geo

A picture of what West Antarctica looked like when its ice sheet melted in the past can offer insight…

The celibate, dancing Shakers were once seen as a threat to society – 250 years later, they’re part

‘The Testament of Ann Lee,’ Mona Fastvold’s 2025 film, depicts part of the long history of Shaker…

From truce in the trenches to cocktails at the consulate: How Christmas diplomacy seeks to exploit s

World leaders like to talk up peace at Christmastime. But alongside the tales of seasonal breaks in…