Venezuela and US edge toward war footing − but domestic concerns, international risks may hold Washi

US military buildup in the Caribbean has prompted Venezuelan President Nicolás Maduro to reciprocate with military drills.

For many in Venezuela, the question is no longer whether tensions with Washington will reach a boiling point – they already have. Rather, the big unknown now is whether the U.S. will follow up on threats and the sinking of drug boats with something more drastic: direct military engagement or even regime change.

Certainly, Venezuelan President Nicolás Maduro is preparing for all eventualities. On Sept. 29, 2025, the leftist leader signed a decree granting him additional powers. The following day, Maduro threatened a “state of emergency.” Already, Caracas has carried out military drills amid talk of being a “republic in arms.”

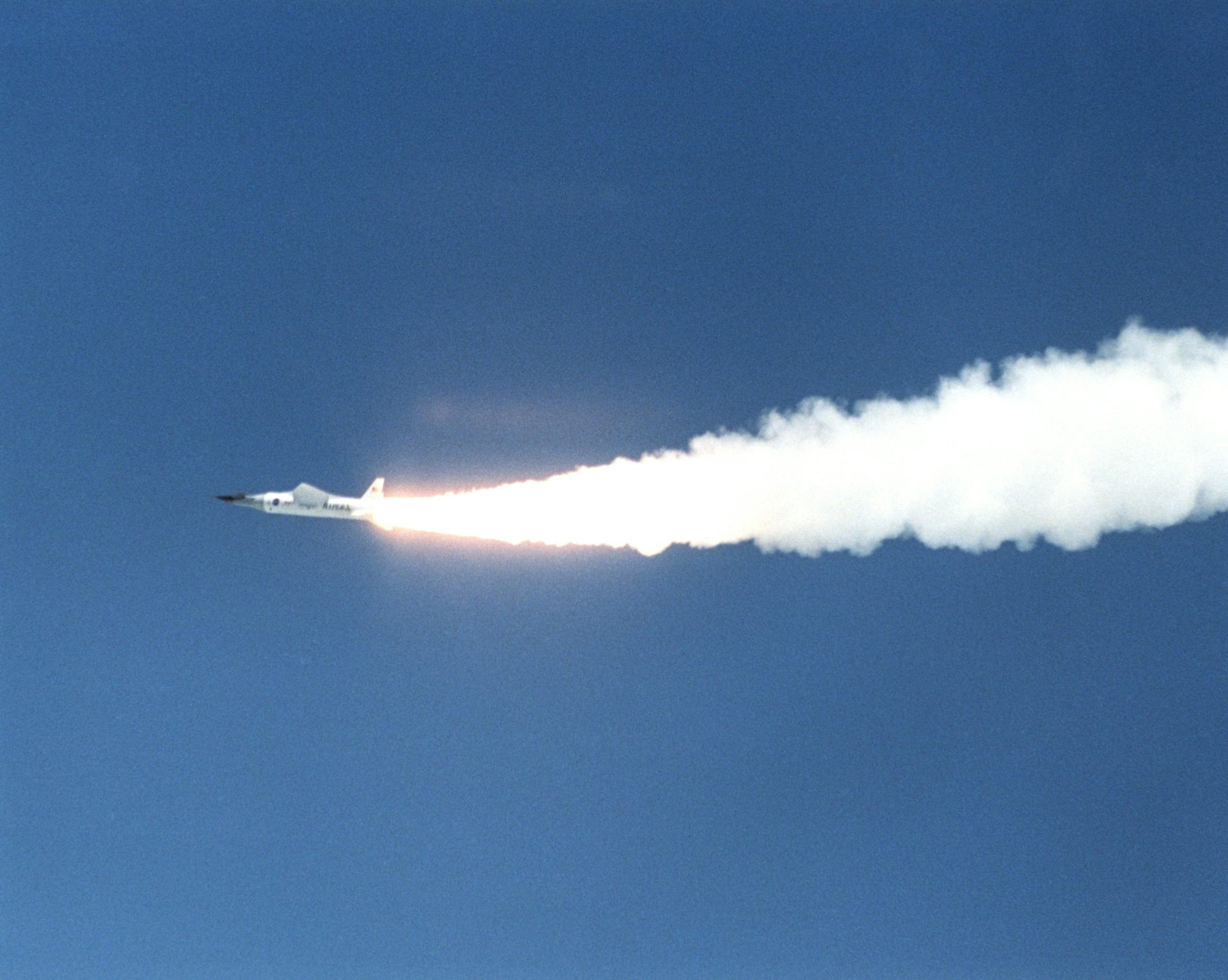

It follows a month in which Washington has positioned warships, an attack submarine and aircraft in the Caribbean and destroyed at least four suspected “go-fast” drug boats. At the United Nations General Assembly on Sept. 23, U.S. President Donald Trump warned of more to come, vowing to blow drug traffickers “out of existence” while repeating his assertion that Maduro was behind the trafficking networks.

Maduro and his generals deny that charge. Nonetheless, Washington has set a US$50 million dollar bounty on Maduro’s arrest and has rejected Venezuela’s appeals for talks.

As an expert on international security and U.S.-Latin American relations, I believe the U.S. position appears to be inching toward regime change from a prior position of ambiguity that has fallen short of an outright pledge to remove Maduro.

But Washington will be aware that any direct military engagement in Venezuela will be a messy affair. Despite increasing international isolation, Maduro still has friends in Moscow and Beijing, as well as closer to home in Havana. And such factors may force the Trump administration to continue to walk a fine line between maximum pressure on the Maduro government without full commitment to armed conflict.

US ramps up pressure

Recent deployments by the U.S. Southern Command demonstrate a shift in posture by the U.S. administration.

The USS Stockdale became the ninth U.S. Navy vessel and third destroyer – alongside USS Gravely and USS Jason Dunham – to join the USS Iwo Jima Amphibious Ready Group maneuvering between Puerto Rico and the Lesser and Leeward Antilles, and the waters north of Venezuela. In all, at least 4,500 Marines and sailors are positioned in the area.

Meanwhile, at least 10 F-35 fighters and multiple MQ-9 drones are reportedly operating from Aguadilla and Ceiba airports in Puerto Rico, offering the capacity for persistent surveillance and strike options.

These forces are more powerful than the entire Venezuelan navy but reportedly fall short of the forces needed for a full-scale invasion.

For the moment, SouthCom is framing the campaign as enhanced counternarcotics operations, rather than a prelude to a blockade or invasion. Statements have highlighted joint patrols and interdiction efforts with the Royal Netherlands Navy, Canada, the Dominican Republic and the United Kingdom, and the humanitarian or information-sharing nature of missions.

SouthCom has described its position as one of readiness, not war. But this could change, especially with the much-anticipated 2025 national defense review expected to prioritize countering the perceived threat of Chinese interference in the Western Hemisphere.

And it is worth recalling that the U.S. has long maintained a light but steady military footprint in the region.

Caracas pushes back

Caracas has staged military displays of its own.

Defense Minister Vladimir Padrino López announced on Sept. 15 three days of drills involving naval units, aircraft air-defense assets and militia participation. Maduro has declared “maximum preparedness” and threatened to mobilize a “republic in arms” if attacked.

If enacted, the state of emergency would be effective for 90 days and centralize military control in the office of the president. The aim is clear: to project resolve and raise the cost for Washington of any further escalation.

Venezuela’s military is not negligible, but readiness has been eroded by decades of economic crisis, sanctions and maintenance shortfalls. It is no match for U.S. military dominance at sea or in the air, although it could inflict damage through asymmetric tactics and militia mobilization.

On the U.S. side, the means for coercion through targeted strikes, interdictions, cyberattacks and sanctions are already at hand. Further escalation may, however, hinge on a catalyzing event, such as an attack resulting in the killing of Venezuelan or U.S. military personnel.

Adversaries and allies

Regionally, most governments have avoided taking sides. One exception is Colombian President Gustavo Petro, who at the United Nations General Assembly called for “criminal proceedings” over the recent U.S. strikes.

In the Caribbean, there is little appetite for hosting a U.S. invasion force. The president of Dominica noted in her speech at the General Assembly that “there is no place in the Caribbean for war.” One exception is Guyana, which is locked in a territorial dispute with Venezuala over the oil-rich Essequibo region and has welcomed U.S. security cooperation.

Yet, an attack on Venezuela or an attempt at regime change risks rallying the country’s allies.

First among them in the region is Cuba. Cuban intelligence and security advisers have long been embedded across Venezuela’s military and security services. This gives Maduro some resilience against internal coups and complicates U.S. efforts to precipitate elite defections from Maduro’s inner circle.

While expressing political support for Maduro, it is highly unlikely that Cuba would ever be in a position to supplement any Venezuelan combat forces given Havana’s own weak position, struggling economy and relatively modest military capabilities.

And despite fresh affirmations of solidarity and the continued presence of Russian “military experts,” Moscow also lacks the political military bandwidth for large, new deployments. Still, long-standing military and technical ties such as training, maintenance, weapons sales and selective systems support offer Maduro a modest but valuable hedge against external pressure.

Even a token port call or bomber overflight could add political friction – and pause for thought in Washington. Russia has sent nuclear-capable bombers to Venezuela in the past, and its navy made a publicized visit to La Guaira in July 2024.

Oil in the balance

One much more consequential factor could be the position of China.

Beijing plays a consequential role as a buyer of Venezuelan oil. As Western sanctions have set in, a growing share of Venezuelan hydrocarbon exports is now funneled through “shadow fleet” tankers and complex rerouting schemes, allowing crude to reach Chinese refineries despite sanctions and export restrictions.

Any U.S. campaign that disrupts these flows would hit Chinese refiners first. This would likely prompt Beijing to push back diplomatically and commercially.

In late September, China stressed that it “opposes the use of force” and decried external interference in Venezuela’s internal affairs – a clear rebuke of the U.S. military buildup.

The Chinese ambassador in Caracas has also conveyed solidarity to his host, emphasizing that Beijing will “firmly support Venezuela in safeguarding sovereignty, national dignity and social stability.”

China is offering diplomatic support but has stopped short of any pledge of force.

For now, America’s most likely path is, I believe, coastal policing and military pressure. At sea, this means the U.S. continuing to lead counternarcotics operations, but with Navy cover close at hand. The U.S. buildup could well boost underground opposition networks in Venezuela, increasing pressure on the Maduro regime from within.

This will be paired with increased financial pressure in the form of sanctions aimed at further squeezing Venezuela’s state oil industry, but calibrated to avoid a global energy shock. Measures also include restricting dollar-clearing and maritime insurance, blacklisting intermediaries and dark fleet tankers, and targeting front companies.

Pressure short of war

Nonetheless, expectations of a military clash are edging upward. Several forecasters now put the odds of some form of U.S. strike against Venezuela before year’s end at roughly 1 in 3, with the chances rising further into 2026.

Yet the prospect of an outright invasion remains, I believe, remote. U.S. domestic politics may act as a brake: Opinion polls show most Americans oppose military action to topple Maduro, and an even larger majority reject the idea of a full-scale invasion.

Even so, three factors could shape if and when Washington steps up its action: a deadly incident at sea involving civilians or U.S. personnel; hard evidence that Venezuelan officials are directly tied to large-scale trafficking to the U.S.; and regional governments lining up behind stronger action.

While the odds of a strike and even regime change are rising, Washington’s strategy in the very near term appears to remain one of pressure without full commitment, using shows of force, sanctions and selective strikes to weaken Caracas while avoiding being dragged into a messy war or sparking an oil shock.

Dr. Robert Muggah is affiliated with the Igarapé Institute and SecDev.

Read These Next

Congress once fought to limit a president’s war powers − more than 50 years later, its successors ar

At the tail end of the Vietnam War, Congress engaged in a breathtaking act of legislative assertion,…

Housing First helps people find permanent homes in Detroit − but HUD plans to divert funds to short-

Detroit’s homelessness response system could lose millions of dollars in federal funding for permanent…

With Artemis II facing delays, NASA announces big structural changes to the lunar program

Artemis II has been plagued by similar issues to those faced by its predecessor, leading NASA to shake…